The economic recession has affected the US housing market disproportionately. The problem is that the local, regional and nation media outlets are very good at pointing out the obvious bad markets like Las Vegas, Miami and Phoenix, but they are very bad at explaining where the rest of the local markets are in the housing cycle. In fact, most media outlets are simply content with spouting out static market data without the necessary analysis that would follow in your Economics 101 class in college. This leaves buyers and sellers having to decipher their local housing market riddle themselves.

What Nashvillians believe about the condo market

In an effort to find out what the general public in Nashville thinks about the downtown condo market, I used the oldest method in the book, I simply asked. It turns out that 79 out of 100 people not in the real estate or development industries thought that the Nashville condo market was about to crash. That’s a pretty large percentage.

When I asked how long they thought the condo market would take to turn around, the average answer came out to 5.7 years. That’s a pretty long time to reach the bottom.

When I asked how bad do you think prices are now and what year in the past would you equate our current pricing I got very consistent answers. All 100 said that recent auctions and “too many condos” on the market have driven prices down and made this a horrible time to buy a condo. The average equivalent year in Nashville’s past was guessed to be mid 2002.

When I then asked what defined “the bottom” of the condo market, I got a bunch of media-like answers and a couple more dynamic answers too. Most people said that the bottom of the market was at the point where prices began to go back up. Some said that the bottom was the point at which existing inventory began to appreciate – interesting. A couple others said that the bottom was the point at which developers and banks began to build new high-rises – also interesting.

What the data shows about the Nashville condo market

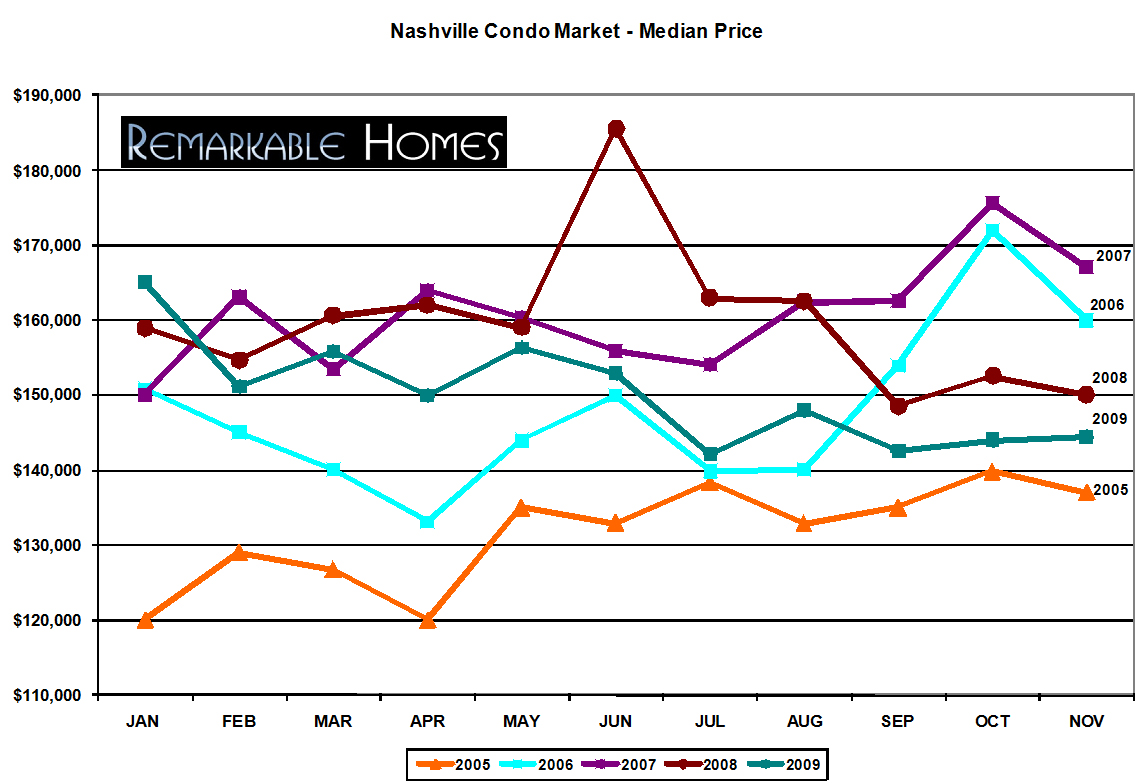

Let me first start with everyone’s hot button, price. Most are not surprised to learn that the average median price for a Nashville condo is lower than it was for each of the past 3 years, but all are very surprised to hear that all of those average prices are higher than 2005 prices. another interesting fact is that the median price has been rising for the past 2 months and will most likely rise again in December. Have we reached a median price bottom? That is very had to conclude at this time.

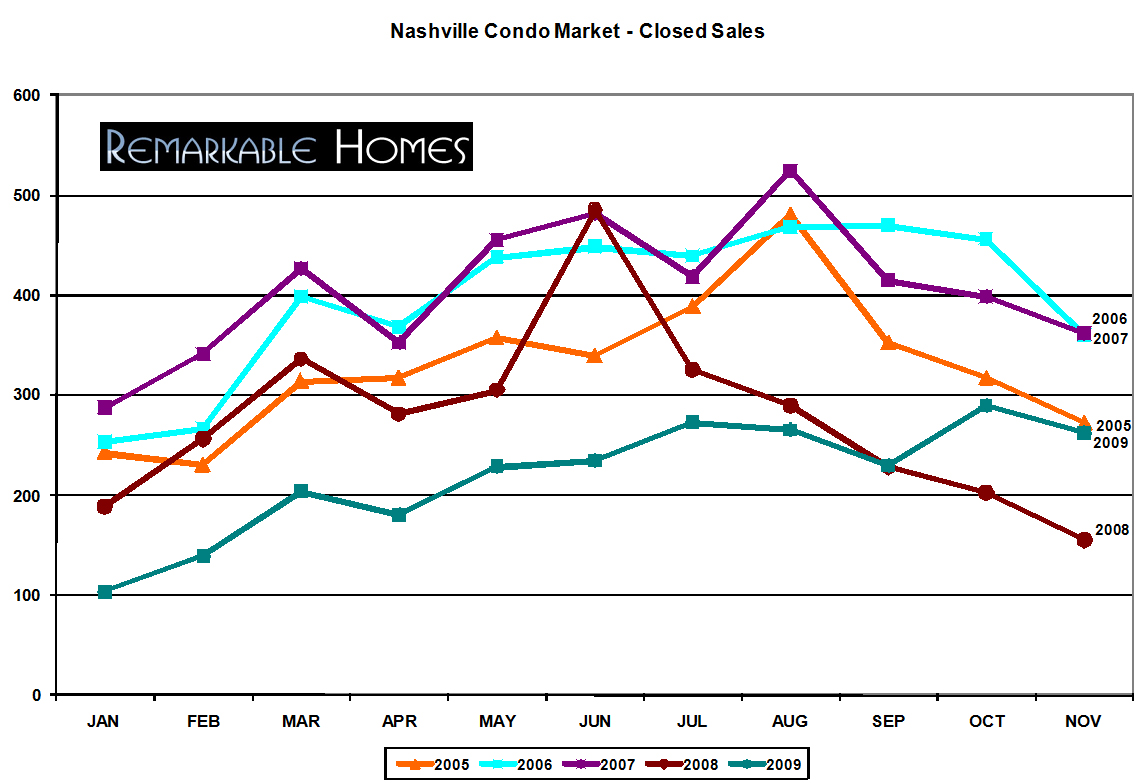

When I asked people about their opinion of the bottom of the market, many eluded to a time when the prices began to rise, but some touched on a time when more condos were sold. Looking at the historic data, the Nashville condo market closings are quite strong. So strong in fact that we’ve eclipsed 2008’s numbers and are coming closer and closer to doing the same for 2005’s numbers as well. More importantly, if you only look at the 2009 data line and were to draw a trend line, you’ll notice a bull upward slant for the past 11 months. Even in a time when our traditionally cyclical market loses momentum, the Fall 2009 condo closings are bullish.

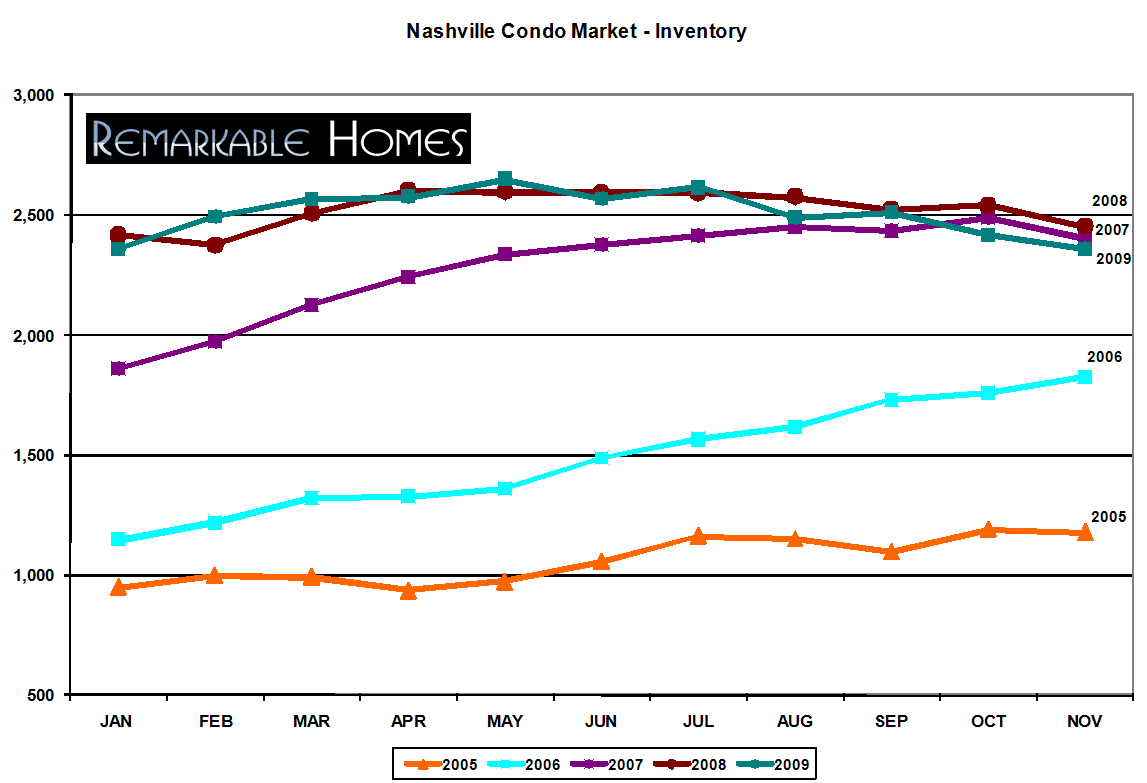

There is one area where the general consensus is correct, inventory. Our total condo market inventory is still flirting with 2007’s and 2008’s highs. At the moment, the 2009 inventory levels are lower than each of the past 2 years, but are still significantly higher than 2006 and certainly 2005. None of these inventory levels reflect the shadow inventory, but one must believe that shadow inventory levels are currently higher than they have ever been. The good news is that condo inventory levels have been dropping consistently since May 2009 when developers began to offer close out specials in earnest in an effort to dissolve their higher than usual inventory.

Nashville condo market analysis conclusion

It is not mid 2002 again in the Nashville condo market. Prices have not dropped to the pre-boom prices of 2003-2004. Inventory levels are still higher than what our market has traditionally carried and they are ever so slightly falling.

In my opinion, we are at the bottom of the condo market in Nashville. The next 12 months will be the absolute best time to acquire a condo and also be the worst possible time to sell a condo. Condo median prices will more than likely remain stable, but inventory will continue to burn off as the higher priced condos are sold at discounts that include big developer incentives. As a result, the average price per foot in each of the larger condo high-rises with developer owned inventory will fall to net record lows. The number of sales will continue to accelerate as more buyers begin to realize that the most desirable condos are disappearing from the market and jump off the proverbial fence. Buyers who are not equipped with all of the facts will indeed pay a higher amount than those buyers who seek out expert opinions and research. Those with a Warren Buffett mindset will be the ones who profit in just 3-4 years when prices spike due to a shortage of condo inventory.