Do you know that sinking feeling you get sometimes? You get a nagging feeling that you just cannot shake and you’re sure that something is about to go wrong, but you have no idea what it is. Well, I got that feeling tonight when I was awakened by our screaming newborn. Of course, at first I thought that my sinking feeling somehow involved our 4 week old, but then I walked over to my computer and downloaded what may be considered the beginning of the end for the Terrazzo and the Gulch.

A little more than a week ago I reported that Canyon Johnson, the money behind the Terrazzo had let Zeitlin Realtors go as the listing company for the project. A day later I also reported that the Lipman Group, a company that had never listed a high-rise condo project, was taking over and questioned that decision thought process. Now, I have come to fully realize the implications of this move and just how horrible it might be for Nashville as a whole. In fact, Larry Lipman’s company could be in danger of becoming the company known as “The real estate company that killed downtown Nashville living” if their risky scheme backfires.

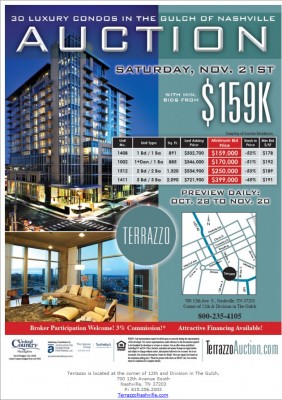

It appears that in conjunction with the Boston-based auction consulting firm, Accelerated Marketing Partners, and locally operated United Country Auctions, the Lipman Group is going to forge into the great unknown of luxury high-rise auctions. By the way, do you know what United Country’s company slogan is? “America’s Rural Real Estate Company”! I am not kidding you, look at the website yourself. Holy crap Batman!

Well, it might not be that bad, Accelerated Marketing Partners has done several of these auctions in the past, but looking at their website, I then realized that these guys are just liquidators. Most of their auctions are in depleted markets like Atlanta and all over Florida, but I did see a few auctions in their home city of Boston and became hopeful once again. That is until I read the recent Boston.com news article about the results of the sale. The article clearly stated that some buyers purchased condos for up to 41% less than asking price. Whoa.

And why in the world are they holding the auction in a hotel ballroom a half mile from the building? It stands to reason they would want bidders to be in the actual building to build excitement on auction day. There’s a ton of space to hold the event in the more than 8,000 square foot vacant restaurant space on the ground floor. Is the building not good enough for these guys?

Let me recap the story so far. Terrazzo condo sales are not going so well and so the financier lets listing company go in favor of a high-rise unknown. High-rise unknown then partners with New England auction consulting firm and local farm auction company and plans to auction off 30 luxury condos in a unrelated hotel. In order to let the local real estate community know of this incredible opportunity, they fire off a mass email in the middle of the night. Maybe it’s me, but this thing seems doomed before they even start bid calling.

Maybe I am being overly hard on these guys, or maybe I am not. Either way, I really cannot wait to hear the reaction from the Bristol Group and MarketStreet Capital. I would hate to be the agent who sold a Terrazzo condo to their best client right now.

It seems to me that the result of this auction will be one of two things: 1) The auction will go well. The uniqueness and buzz creates a lot of awareness and energy that results in the condo buying public jumping off the fence and back into the market. The prices paid are very respectable and now the Terrazzo has effectively jumpstarted the downtown condo market and deserves a little praise. The rest of the condos in downtown don’t receive a price boost, but they all receive an interest boost and things are good, or 2) the auction is either only semi-successful or a flop and now everyone who was on the fence becomes a vocal naysayer. All of a sudden the downtown Nashville condo market becomes a punch line to real estate jokes and all condo projects are hurt from this failed attempt to sell units in just one ill-located building. Crosland, Bill Barkley, the Lipman Group, United Country and all others involved in this effort become a real estate anecdote to the downtown real estate discussion.

This morning the Tennessean came out with a story about the auction and managed to quote the CEO of Accelerated Marketing Partners as saying, “This will have major repercussions in Nashville in terms of value.” He went on to say, “People will look at these auctions to determine what they want to pay for properties in Nashville. Particularly in a market that has declined like this market, where there is a disconnect between buyers and sellers, this event will break the logjam.”

Clearly, this is a prepared statement that this guy has given in lots of other markets and clearly shows that has not done very much research in Nashville. I don’t see a 6% year over year price decline as a “logjam”. It’s a shame that these guys take such pride in devaluating real estate markets.

See all condos for sale in The Terrazzo