The results of the Terrazzo auction are in and it appears that my predictions are right on target. 25 condos sold at an average price of $233.01 per foot with a couple of sales reaching over the $250/ft mark. The average total price of $283,600 represents 62.48% of the original asking prices at Terrazzo.

Approximately 220 people attended the auction at the Renaissance Hotel in downtown Nashville, but I was never able to count more than 47 registered buyers. The auctioneers, Accelerated Marketing Partners, did add 4 new condos to the auction that were not listed prior to auction day.

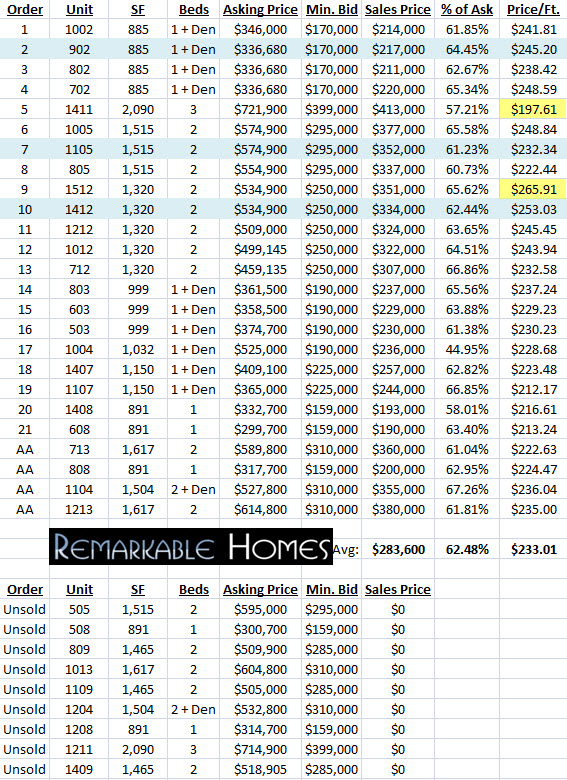

21 condos sold during the actual auction and 4 sold after the bidding was stopped (marked as AA in the table below). The live auction portion lasted one hour and six minutes and the after auction sale only took 14 minutes. The entire auction and sale only lasted one hour and twenty minutes. In other words: During the 80 minute auction, $92,162.50 was spent per minute. Without further delay here are the complete auction results from today’s Terrazzo condo auction:

Initial reactions to the Terrazzo Auction

It is a good sign for the Nashville condo market that 25 buyers are available in the Nashville market who can dole out $7,373,000 in one afternoon. I would also agree that $233/ft is the correct market price for 25 condos sold in this manner. I do not believe that it is an overall commentary on the true market price. If you were to believe that $233/ft is the true current market rate, you would also have to believe that 9,125 condos are selling in a year (25 condos x 365 days). That being said, the true market rate for these type of condos has fallen as a result of today’s auction at the Terrazzo. I will discuss by how much in the next series of articles over the next 5 days.

The market has just told developers with unsold inventory in the Gulch that their condos are not worth $300/ft in the current 2009-10 market. Perhaps the memory of the auction will fade in buyers’ minds after a few months, but if the Terrazzo re-prices all of their remaining condos much lower, it could have a longer lasting effect.

See all condos for sale in The Terrazzo