This article entitled “Terrazzo auction will impact condo prices across Nashville” appeared in the Nashville Business Journal on November the 6th, 2009. The author is Eric Snyder:

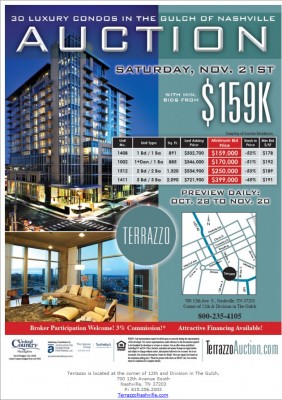

Velocity, the last new condo project that will come to the downtown Nashville market for several years, has officially opened its doors. Meanwhile, Terrazzo, one of downtown’s more luxurious condo towers, is poised to slash its prices by as much as half at an upcoming auction.

The stage appears set to at least create momentum to move units. What’s less clear is whether that momentum will come as a result of severely discounted prices – not just at Terrazzo, which is selling 30 of its 117 units for up to 50 percent off original asking prices, but across the market.

Grant Hammond, a buyer’s broker who specializes in condos, said the Nov. 21 auction will serve as a “crystal ball.”

“This should tell everyone exactly where the market is for downtown living,” said Hammond, who will represent two potential buyers at the auction. Hammond said the auction will determine whether the downtown market is viable, or whether it’s moving toward or away from viability.

Hammond will set his compass by final sales prices, adding that auction prices of $250 a square foot will represent a viable market. Read Eric Snyder’s full Nashville Business Journal article.

I have to admit that I was pretty offended by this auction when I learned of it a week ago. It seemed that the Terrazzo owners had skipped a couple of logical steps in the sale process. As I have learned more about this particular sale, I am actually coming around in this particular situation. However, I will say this: If there are any developers who try to do a similar auction in 2009, they will get killed. Copycats always get killed. Just call the developers of the Aqua condo tower in Atlanta who tried to copy an earlier Accelerated Marketing Partners sale.

It appears that auction attendance is going to far exceed everyone’s expectations and that there really are quite a few end using condo buyers that exist in the Nashville market. While the lack of sales in the Terrazzo shouldn’t be an indication of past demand, the renewed interest in this class A building in a class C location is quite encouraging for a number of reasons.

When you break down the available condo inventory in downtown, you find that the numbers aren’t as bad as you may have been led to believe. What does appear to be at odds however, are the wishes of current condo owners and condo developers who want to build again. Owners are hoping for prices to remain stable during the next 1-3 years of inventory burn-off whereas developers would rather see prices fall to the point where 100% of the inventory burns off in one year.

I see the arguments from both sides and each has a valid point, what I have not determined is the perfect solution for both owners and developers. What I am sure off is the fact that the Gulch does have legs. The Icon has been selling very well during a recession and once Velocity gets a little more serious about their prices, it will be the most affordable entry property in the downtown market. The Gulch is quickly becoming a ‘see and be seen’ neighborhood in Nashville as certain celebrities tend to slink in and out of 2 restaurants in particular.

See all condos for sale in The Terrazzo