Most real estate professionals would agree that the extended first-time home buyer credit has led to an increased level of purchase activity in Nashville. However, most tend to also believe that this activity has led us to a point when you can call the Nashville real estate market ‘recovered’. I can see why you may feel that way considering the combined optimism of a better than last Spring selling season and the fading memory of bank collapses and insurance company overextension. In fact, I have even seen many sellers stiffen their backs when lower than asking price offers have been presented in hopes that the 2010 market will net a higher offer a few months down the road.

Most real estate professionals would agree that the extended first-time home buyer credit has led to an increased level of purchase activity in Nashville. However, most tend to also believe that this activity has led us to a point when you can call the Nashville real estate market ‘recovered’. I can see why you may feel that way considering the combined optimism of a better than last Spring selling season and the fading memory of bank collapses and insurance company overextension. In fact, I have even seen many sellers stiffen their backs when lower than asking price offers have been presented in hopes that the 2010 market will net a higher offer a few months down the road.

Don’t be Foolish!

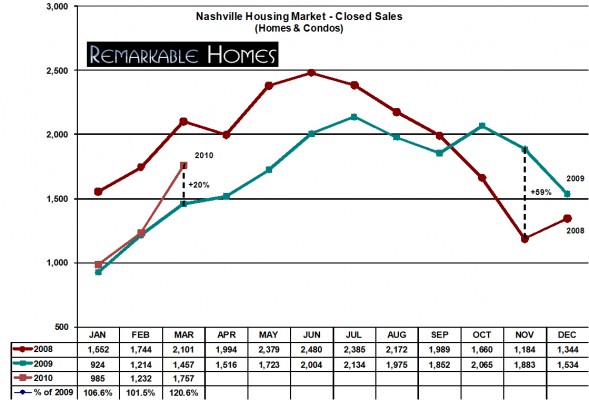

History is a great professor and it’s time to go back to class. Yes, March 2010 closing are 20.6% higher than those of 2009, but they are also still 16.3% lower than in 2008, a recessionary year, which did not see any government incentive induced real estate sales. Yes, it is also true that we have seen 6 straight months of year over year gains in closings, but the first-time buyer credit concludes at the end of April with little indication that the program will be extended. At one point during this run, year over of year sales were trending 59% above the previous year’s, it is no coincidence that this spike directly coincided with the end of the government’s initial first-time buyer credit program. I suspect that we’ll see this same phenomena repeated this Spring.

Click image to Enlarge

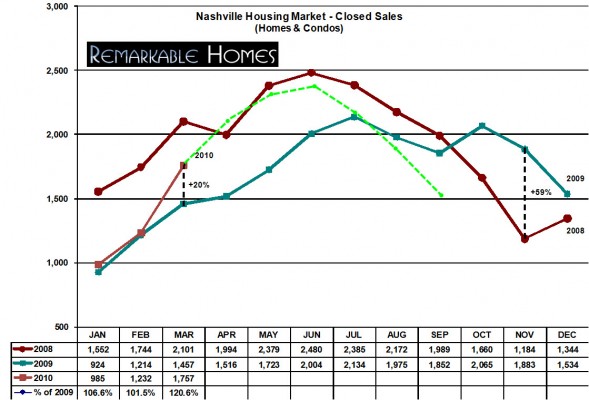

April 2010 Closed Homes Prediction for Nashville

I am going to go out on a limb and make a prediction that I am going to guarantee. The number of closings in April 2010 will exceed those of 2008. In March of 2010 there were 1,757 closings, April of 2008 recorded 1,994. I am predicting that the Nashville market will experience at minimum another 13.5% month over month increase in the number of closings or 237 more closings. This increase in sales is so closely tied to the first-time buyer credit that I will also make another bold prediction. Should the government not extend the credit for a third time or reestablish a mortgage backed securities buying program, by August 2010, closings will back below 10 year lows. The dotted green line represents that probability based upon an extrapolation of combined inventory predictions and fixed 30 year mortgage rates.

Click image to Enlarge

Take-Away Points for Buyers and Sellers

- If you are a seller who has received a reasonable offer for your home or condo, negotiate judiciously then take the money and run.

- If you are a buyer who is in the market for a steal, wait. Unless your buying power is dependent upon the today’s mortgage rate, wait.

- If you are a cash buyer for an individual home or condo, your day has not yet come. Wait until the end of Summer and you are guaranteed to rip a seller’s heart out by their wallet.

- If you are a casual seller who is only trying to sell your property in order to be able to take advantage of a distressed seller, stock up on patience. However, the best homes do sell, so make your property the best it can be.