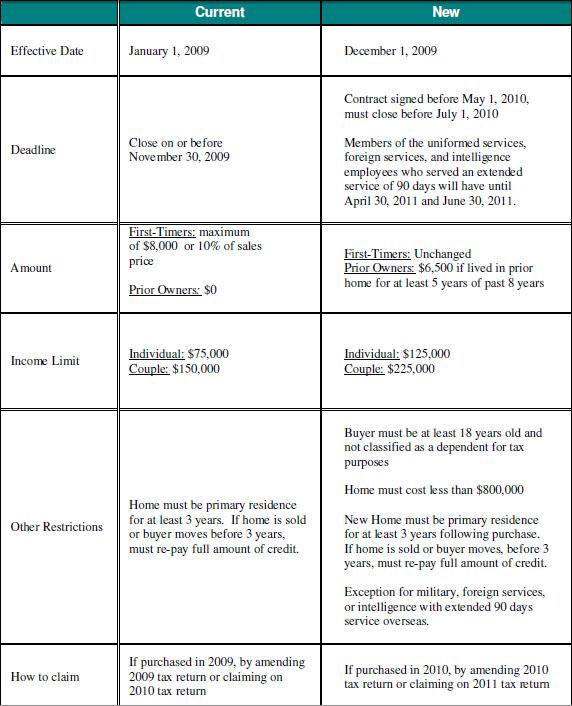

If you feel like the first time homebuyer tax credit was a sweet deal that you missed out on, you’ll now have another shot, the program has now been extended through April 30, 2010.

The Tax Credit was also amended to include move-up buyers who’ve been in their current home 5 consecutive years over the past 8 years. Those eligible buyers will receive a $6,500 credit, as opposed to the $8,000 for first timers. Eligibility will be limited to an income of $125,000 for individuals and $225,000 for married couples. There is also a limit on the price of the home you can buy, $800,000, which was not the case before. This increase has included an additional 14% of the population that were not eligible under the previous program.

More good news for the real estate market, FHA has amended the condo qualification standards to be more lenient and accessible to condo buyers effective December 7th, 2009 through February 1st, 2010.

The original first-time homebuyer tax credit jump-started the housing market, driving home sales to the highest level in more than two years. The National Association Realtors reported sales jumped 9.4 percent to a seasonally adjusted annual rate of 5.57 million units in September and are 9.2 percent higher than the 5.10 million-unit pace in September 2008.