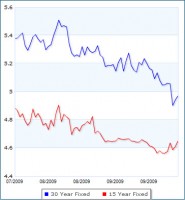

30 fixed mortgages moved closer to the all-time low of 4.82 percent reached in May 2009, falling to 4.87 percent last week from 4.94 percent a week earlier, according to Freddie Mac. Homeowners who refinance have an opportunity to reduce their payment on a $200,000, 30-year, fixed loan by nearly $134 a month from a year ago, when long-term rates averaged 5.94 percent. Also, 15-year loans fell to 4.33 percent, and 5 year adjustable-rate mortgages dropped to 4.35 percent; but 1 year ARMs rose to 4.53 percent.

I cannot stress how opportune this timing is for purchasing a new home. Nashville has entered into the period of seasonally low home sales which lead to lower prices. Additionally, Nashville home loan rates are artificially low (cannot be maintained much longer) and there is a decent amount of inventory from which to choose. Sellers have been pushed back onto their heels and aggressive offers are rewarded more than usual. The next 3 months could be described as a “buyer’s perfect storm”.