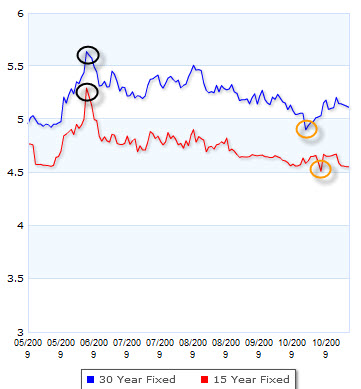

Freddie Mac reports that Nashville mortgage rates continued to drift higher last week, with average interest of 5.03 percent on a 30-year fixed loan – up o.o3 percent from a flat 5 percent the previous week. The government-sponsored enterprise reports that 30-year fixed rates have been hovering around the 5 percent mark as a result of government intervention. The result has been a refinancing boom, with refinances accounting for seven of every 10 mortgages this year. 15-year fixed loans crept up to 4.46 percent compared to 4.43 percent a week earlier.

Bankrate.com’s national survey of large lenders put the benchmark 30-year, fixed-rate mortgage at 5.35 percent, up slightly for the third week in a row. The Mortgage Bankers Association says applications have fallen more than 25 percent in the past two weeks, but also concedes that rates should fall this week causing mortgage applications to increase.

Mortgage rates are not the reason why the real estate market is on pause

Buyer reluctance coupled with stubborn sellers are the true reason. Simply put, the gap between what sellers need to get and what buyers want to pay is still too far apart for the Nashville market to begin to return to a normal pre-boom self-sustaining market. What is moving are the distressed and motivated sellers like builders, developers, corporate relocations and the unfortunate few who are experiencing financial difficulties.

The good news is that when one of these ‘motivated’ sellers does shake loose from the pack, there are plenty of buyers present in the market to snap that property up with very few days on the market.