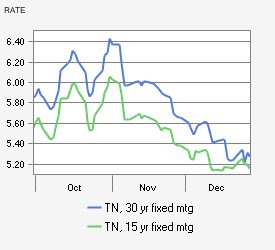

In response to the Federal Reserve’s cut in the federal funds rate to near zero, Freddie Mac reports that the 30-year fixed mortgage rate fell to 5.17% during the week ended December 18 – down from 5.47% the previous week and the lowest since 1971!

Interest on 15-year fixed loans slipped to 4.92% from 5.20%. Meanwhile, the five-year hybrid adjustable mortgage rate dropped to 5.60% from 5.82%; and the one-year ARM dipped to 4.94% from 5.09%. A year ago, the 30-year fixed rate stood at 6.14%, the 15-year fixed rate at 5.79%, the five-year hybrid ARM at 5.90%, and the one-year ARM at 5.52%.

This incredible drop in rates has kicked off what might be the largest refinance boom in the past 3 decades. We certainly expect borrowers to kick those adjustable rate mortgages to the curb in favor of the safer and more secure fixed rate mortgages.