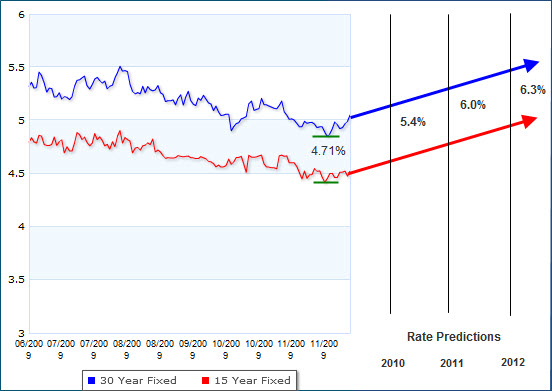

Mortgage interest rates on 30-year fixed mortgages rose to 4.81 percent last week, after the prior week’s fall to a record low of 4.71 percent, reports Freddie Mac.

While the Federal Reserve’s effort to purchase $1.25 trillion in mortgage-backed securities issued by Fannie, Freddie, and Ginnie Mae has helped keep rates attractive, Freddie Mac chief economist Frank Nothaft says interest rates rose because a favorable unemployment report pushed long-term bond yields up slightly.

With the Fed program projected to end in March, the Mortgage Bankers Association forecast in October that 30-year fixed mortgages will rise to 5.4 percent next year, increase to 6 percent in 2011, and hit 6.3 percent in 2012. Clearly, this would be a great time to refinance your mortgage, if your lender will let you.