Freddie Mac reports that interest on most long-term mortgages rose this past week. According to the firm, 30-year fixed loans came in last week at an average rate of 4.91 percent, up from 4.82 percent a week earlier; while 15-year fixed mortgages settled at 4.53 percent compared to 4.50 percent over the same period. Interest was also higher on five-year adjustable-rate mortgages, which bumped up to 4.82 from 4.79; but the one-year ARM slipped down to 4.69 percent from 4.82 percent.

The increases are the byproduct of a big jump in yields on long-term Treasury bonds, which impact the cost of home loans. In months past, Nashville mortgage rates were able to withstand the rising yields, but rates were bound to catch up. These rising rates seem to have put a damper on Nashville real estate sales as there were 11 percent less homes contract this past week that the week before.

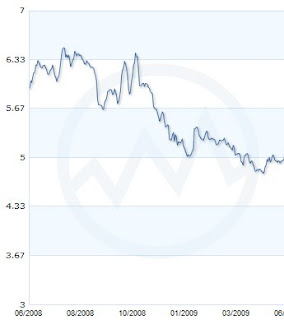

To refinance or not to refinance: looking at the graph, it appears that a month ago was the best time to lock in your mortgage refinance, but there is substantiated rumbling that Obama may reintroduce the HASP program with greater benefits in the coming months.

Update on HASP program 8/2/09: It is clear that Obama’s program was not only not well run, but completely ineffective. Less than 10 percent of eligible homeowners were able to take advantage of this much needed, but poor run program. Very disappointing.