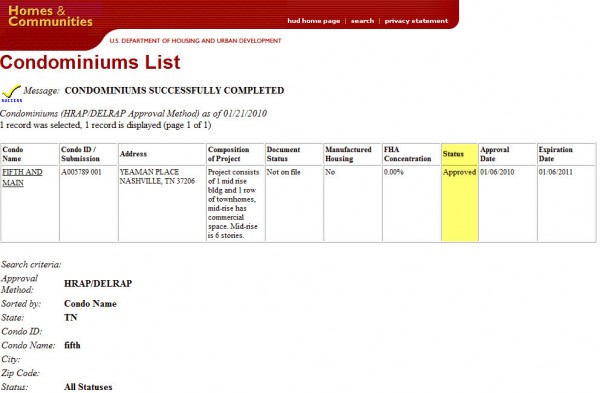

The 5th & Main condo project in East Nashville, the first large condo project to enter receivership in February 2009, has received approval to issue FHA insured loans (according to the HUD website). The project has qualified under the new, lower FHA guidelines that only require a project to be 30% presold in order to qualify for the government backed loans. The FHA loan concentration has also been temporarily increased to 50% concentration and owner occupancy has been reduced to 50%. The changes in FHA guidelines could not have come at a better time for 5th & Main and should lead to quite a few sales over the coming months should Wachovia/Wells Fargo get aggressive with their pricing.

The 5th & Main condo project in East Nashville, the first large condo project to enter receivership in February 2009, has received approval to issue FHA insured loans (according to the HUD website). The project has qualified under the new, lower FHA guidelines that only require a project to be 30% presold in order to qualify for the government backed loans. The FHA loan concentration has also been temporarily increased to 50% concentration and owner occupancy has been reduced to 50%. The changes in FHA guidelines could not have come at a better time for 5th & Main and should lead to quite a few sales over the coming months should Wachovia/Wells Fargo get aggressive with their pricing.

5th & Main is a 130 condo development located on the East bank of the Cumberland River. Up until this point, the developers and listing agents have only managed to close 8 total condos, 3 of which were cash purchases after the project entered receivership. However, that is all sure to change in the near future. In fact, downtown is about to change fast.

Good News for 5th and Main Could be bad for Others

The price point of 5th and Main condos is quite reasonable and sure to get even more so in the coming months. That is great news for the embattled project, but potentially bad news for nearby buildings who have been courting those same value buyers. When comparing numbers to numbers, 5th & Main is sure to stack up very well and is sure to compete for buyers who are interested in newer buildings like Encore, Velocity and Viridian. As rough as that may seem, the real pain will be felt by the smaller projects physically located in East Nashville like mc3 and the East Nashville Lofts.

Only time will tell for sure, but one fact is indisputable: there are a finite number of condo buyers currently in the market and the competition for those buyers is about to get a lot stiffer. Condo buyers are the new “tweens”.