If you were one of those drum beating, forever optimistic, ‘buy now or miss the deal of a lifetime’ type of real estate agents, this is what you might spin this month: Nashville home sales up an astounding 25.8 percent in May. You may also write: Year-to-date Nashville closings are up 20.4 percent through the same period last year. Don’t wait to buy, you’ll miss the best deals.

Of course, you would be correct, but you’d also be misleading your readers.

If you were one of those gong ringing, forever pessimistic, ‘I need to sell some more papers before they eliminate more positions’ type of journalist, this is what you might spin this month: Nashville pending home sales plummet an astounding 15.2% in May. You may also write: As tax credit expires, so do immediate hopes of a Nashville real estate recovery.

Of course, you would be correct as well, but you’d also be telling half truths.

Certainly, there is a happy middle ground between both ‘fictional’ postulators, but the truth is, both are correct in their own respect. Let’s take each one and dissect their intent:

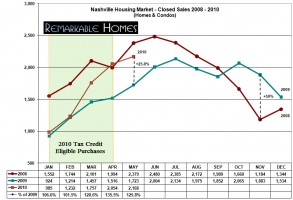

In the first fictional example, this real estate agent is pointing out the well corroborated fact that Nashville real estate closings climbed from 1,723 in May 2009 to 2,168 in May 2010. What he/she fails to mention in their headline is that this 25.8 percent increase is a year-over-year increase. This person more egregiously fails to mention that this increase is directly attributable to the conclusion of the federal tax credit the previous month. Moreover, this person also fails to mention that the month-to-month increase from April 2010 to May 2010 is only 5.5 percent, which is below the majority of accepted estimates. Shame, shame fictitious person. You are a capitalist who is attempting to augment your income by creating optimism and selling more homes.

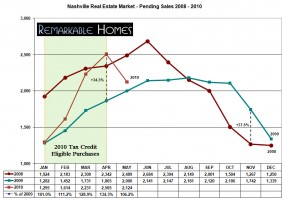

In the second fictional example, this journalist is musing about the same phenomenon, but from the other side of the coin. Naturally, in the months leading up to the conclusion of the federal tax credit, more and more buyers executed purchase contracts. These are buyers who are most likely pushing up their purchases in order to remain eligible for the $8,000 from Uncle Sam. Once our generous uncle retracted his $8,000 offer, there was no reason to push a purchase up in time and the market returned to its normal state. So, did pending sales fall 15.2% in Nashville? Yes, they did. They fell from a 21-month high of 2,505 pending home sales to 2,124. Shame, shame fictitious person, you are a capitalist who is attempting to augment your income by creating fear through sensationalism and selling more papers.

Closed Real Estate Sales Pending Real Estate Sales

Is there any Truth in Real Estate?

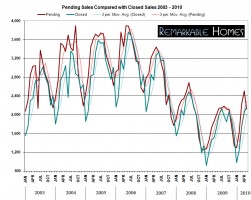

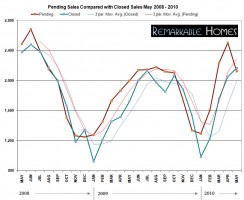

There is, but only if you block out all of the noise. You need to consider long term trends instead of micro-analyzing the short term phenomenon. Once you understand the trend, you can then use microanalysis as one of many tools to determine whether or not this is a good time for you to buy or sell real estate.

Who here did not expect home sales to dramatically increase in the months leading up to the end of the federal tax credit? Especially when compared to last year’s home sales numbers? Of course you did. You understand that this was a stimulus program intended to create just such an effect.

Who here did not expect home sales to drop off after the tax credit ended? All rational people expected this to happen. There is no surprise. This is not headline worthy news, at least, not yet. Time needs to pass before we can draw any concrete conclusions about the effectiveness of this last housing tax credit.

Trust in long term Nashville real estate trends

8 year pending vs. sold analysis Past 24 months pending vs. sold

Of course, who cares about the velocity of sales, you just want to know about prices. Did you catch my research on Nashville home prices?