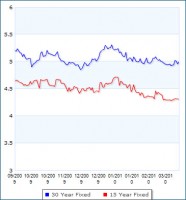

At the end of last week, Freddie Mac reported that mortgage rates remained under the 5 percent mark for the second consecutive week, with the average interest on a 30-year fixed loan coming in at 4.95 percent from 4.97 percent a week earlier. Meanwhile, interest on 15-year fixed loans averaged 4.32 percent versus 4.33 percent the previous week. Rates on five-year, adjustable-rate mortgages settled at 4.05 percent, a decline from 4.11 percent the previous week.

At the end of last week, Freddie Mac reported that mortgage rates remained under the 5 percent mark for the second consecutive week, with the average interest on a 30-year fixed loan coming in at 4.95 percent from 4.97 percent a week earlier. Meanwhile, interest on 15-year fixed loans averaged 4.32 percent versus 4.33 percent the previous week. Rates on five-year, adjustable-rate mortgages settled at 4.05 percent, a decline from 4.11 percent the previous week.

Rates dropped to a record low of 4.71 percent in December and have hovered around 5 percent ever since the Federal Reserve began a program to stabilize the housing market by lowering mortgage rates. The theory is that the reduced borrowing rate increases home affordability and thus, home sales. However, you must take into account that the vast majority of lenders have tightened their qualification standards as well as internally restricting total lending limits leading to a much slower housing recovery than initially expected.

30 Year Mortgage Rates Going Up in April?

The Federal Reserve has confirmed their position that it will most likely stop purchasing mortgage backed securities at the end of March. The FED has been collectively buying the securities since January 2009 which kept the housing market from sinking to lower levels. Because the FED has pumped nearly $1.25 trillion into the MBS market, interest rates have held at historic lows during a very critical time for the housing industry. With the FED backing out of securities business there is no question that rates will begin to rise. But how far?

Most experts are undecided on how much rates will increase. Using the 30 year conforming rate as the guide we’re hearing the 30 year rate could land anywhere from 5.75% – 6.0% and fairly quickly. Most experts expect the rates to fluctuate in this range through the fall and then experience another potential increase during the winter months. Regardless of exactly when, mortgage rates will begin to go higher and soon. I am not an alarmist, but I do play the trends. It appears that unless the FED decides to extend their current MBS purchase program, your chance to secure record low interest rates may be drawing to an end.