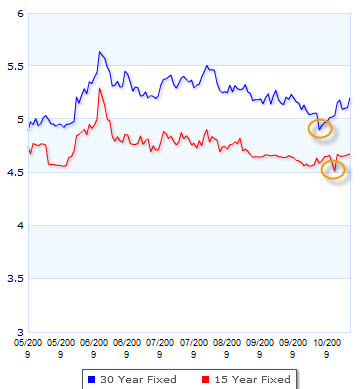

Mortgage applications declined for the second consecutive week and to their lowest level in over a month, as interest on 30-year fixed loans rose to 5.07 percent. The Mortgage Bankers Association reports that its index of loan applications fell 13.7 percent last week, as requests to refinance mortgages sank 16.8 percent and demand for purchase loans fell 7.6 percent. Also, demand for home loans is most likely cooling because the deadline to utilize the first-time home buyer credit is approaching in 34 days.

It’s not so much the new purchase mortgage applications that are worrisome, it’s more that real estate buyers are beginning to slip back into the “wait and see” mentality that can reverse the positive effects of what the first time buyer’s credit has begun to accomplish…