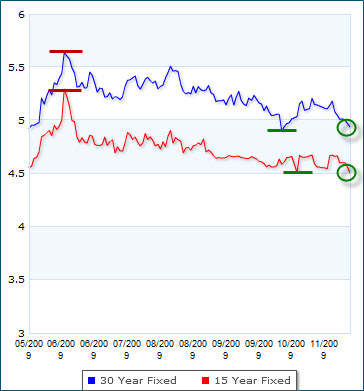

The 30-year fixed mortgage rate fell to 4.91 percent for the week ended Nov. 12, , down from an average of 4.98 percent a week earlier, and has now been below 5 percent for five of the last seven weeks, reports Freddie Mac. Also, 15-year fixed loans fell to 4.36 percent from 4.40 percent; five-year hybrid adjustable-rate mortgages declined to 4.29 percent from 4.35 percent; and one-year ARMs slipped to 4.46 percent from 4.47 percent.

As was discussed in greater detail last week, these low mortgage rates will not last forever. It may seem counter-intuitive, but this may be the best possible time to secure low financing rates and a below market price on real estate in Nashville.

The National Association of Realtors does predict that as home sales increase in 2010 (5% increase is forecasted), so will interest rates. The thought is that as consumer confidence returns to the marketplace, the Fed will slowly respond by inching up the borrowing rates.

Commercial real estate update

According to NAR’s Chief Economist Lawrence Yun, “Who is buying? The answer is no one,” he explained. “The level of transactions is way down. We’re looking at an almost 90 percent decline from peak to current levels.” Simply stated, the commercial real estate market has fallen off a cliff.

One particularly hard-hit area of commercial is the office sector: National vacancy rates are getting precariously close to 20 percent and sales volume has fallen as far as 93 percent from its peak just a few years ago. If your company is concerned about your commercial real estate holdings, you should call or email the guys at Cumberland Commercial in Nashville. Once you read their bios, you’ll understand why.