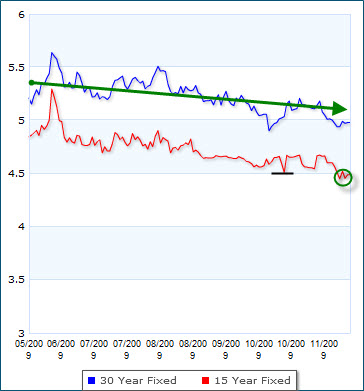

Rates for 30-year home mortgages approached the all-time low of 4.78 percent again last week, falling to 4.83 percent from an average of 4.91 percent a week ago. The 15-year rate did reach a new bottom, dipping from 4.40 percent to 4.32 percent – the lowest level since Freddie Mac began tracking rates in 1991. Wellesley College economist Karl Case says the Federal Reserve’s efforts to purchase mortgage-backed securities from Fannie Mae and Freddie Mac is lowering rates on Nashville home loans.

Rates for 30-year home mortgages approached the all-time low of 4.78 percent again last week, falling to 4.83 percent from an average of 4.91 percent a week ago. The 15-year rate did reach a new bottom, dipping from 4.40 percent to 4.32 percent – the lowest level since Freddie Mac began tracking rates in 1991. Wellesley College economist Karl Case says the Federal Reserve’s efforts to purchase mortgage-backed securities from Fannie Mae and Freddie Mac is lowering rates on Nashville home loans.

An obvious tide of home refinance applications came as a result of these lower rates and for the first time in 4 weeks, new home purchase applications increased by more than 5 percent. Nashville mortgage rates appear to have reached an uncommon low point due to the artifical downward pressure resulting from the Fed’s efforts to purchase MBS paper.

If I have said it once, I have said it 100 times, these rates cannot stay at these levels for very much longer. The Fed is doing everything in its power to help stimulate the US housing market, but at some point, we’re going to have to start paying down the national deficit. I am not telling you to go out there and buy a house or condo right this moment, but this is the time to begin a meaningful discussion.