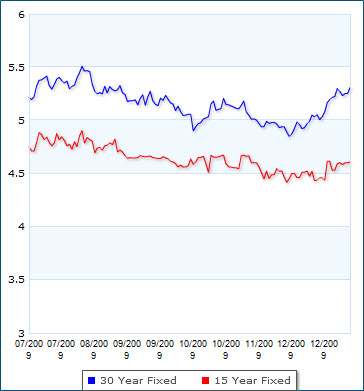

Nashville mortgage rates ended 2009 above 5 percent, with Freddie Mac reporting 30-year fixed rates at an average 5.14 percent, still very affordable by historical standards. Although higher long-term borrowing costs late in the year could signal further increases for 2010, new data from Wells Fargo, JPMorgan Chase, and the Mortgage Bankers Association indicates more borrowers are refinancing into 15-year loans in hopes of paying off home debt faster. According to the Mortgage Bankers Association, 15-year fixed loans accounted for nearly 20 percent of refinance applications in October 2009 – up from 9.1 percent in October 2008 and 7.5 percent in October 2007.

The jumbo mortgage market in Nashville will probably see some programs re-introduced, but underwritten more conservatively with larger down payment requirements. No income verification programs may return at premium rates, but from sources other than conventional lenders. No asset verification programs are unlikely in 2010.

Here are a couple mortgage predictions that I agree with from Boston.com’s Sam Schneiderman:

- Mortgage guidelines will tighten then relax. Some may become specific to certain types of markets.

- Mortgage workouts will be practiced by attorneys that master them. Most lenders will modify only as a last ditch effort to save money.

- Interest rates will go up, but probably not as high as many are predicting, possibly due to government intervention.

- Financing will be available to those that meet traditional “pre-boom” underwriting guidelines and have the credit score, down payment and job security lenders want to see.

- Some seller financing is likely to become more prevalent, especially toward the higher end of the market and in the small multi-family and investment property market.

- Residential buyers will buy because they need a long-term place to live and want to control their own environment and costs. Investors will buy for the long term to lock in today’s rates.