A very astute investor once told me that if I attempted to micro analyze the real estate market based upon short-term data, I would most likely be missing the soul of that market. Yes, I had the ability to make profitable short-term decisions, but I would lack the true understanding of why my short-term decisions were valid. It is this soul of the market that allows one to make accurate predictions and gain a certain comfort level with the velocity, momentum and overall direction of that market. He suggested that if I were to place a long horizon chart on the far side of a room, I would gain the perspective needed to feel at ease with any purchase or sale decision. I took his advice to heart and, ever since, I have been doing just that. But, I have never shared any of these charts on my website until now.

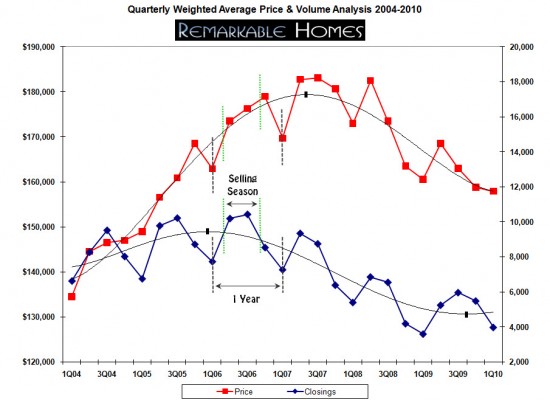

This weighted average mean price compared with volume of sales study of the local Nashville real estate market is one of my favorite charts. If you believe that the volume of closed transactions is an accurate leading indicator for price, as I do, you will see that the Nashville market is most likely entering into a sideways period for the next 12 months. Based upon an 18 month lead variable, it does appear that home prices in the Nashville market will officially recover in May of 2011. This will be the point at which one can say home prices in Nashville are now appreciating on the whole. However, let me caution buyers, if you try to time the bottom, you’ll almost always miss it.

Timing the Bottom of the Nashville Market

Should the national economic landscape not change in some drastic way, from this point forward, you should assume that the average Nashville property is at or near its bottom price. Keep in mind that we are speaking in averages, there are micro markets within Nashville that will continue to depreciate and markets that continue to appreciate independent of the average. If you are attempting to time the bottom of the market, now is the time to truly put forth effort in identifying submarket value deals. My advice is to plan on consummating your purchase prior to the end of this year. Perhaps, our traditional market doldrums of the Thanksgiving season might be the optimal convergence of seller depression and average price lows. That being said, should you identify a property that is currently under market value, do not delay long as a growing number of savvy buyers are beginning to exit their perches on the fence.

Volume of Real Estate Sales in Nashville

It is already clear from April’s numbers that the closing volume will be significantly higher in Q2 2010 than it was in Q2 2009. Granted, this is mostly an artificial result created by the federal real estate tax credit, but that point is entirely moot in this analysis. Provided that no new real estate stimulus programs be created in the near future, the Nashville market should experience its usual Q3 and Q4 volume declines and return to a very steady market in 2011. Nashville will continue to see modest gains in transactional volume throughout 2011, leading to modest gains in the average home pricing.

Predicting Median Prices of Nashville Real Estate

All of you day traders probably saw this trend immediately upon glancing at the above chart: you saw the bull run on prices from the middle of 2007 through the middle of 2008 while there was a very bearish volume of transactions. This was the period in Nashville before we really felt the “what, me too?” effect of the national housing crisis. Directly after that period, Nashville experienced a year of almost geometric price decline that began to temper just 12 months ago. This period of price decline almost perfectly mirrors the price increase realized in the 2005 period. Since that decline, prices in Nashville have remained virtually flat. I would expect this relatively flat, or even slightly declining period to continue through the remainder of 2010.

By the beginning of 2011, the market will begin to feel a lot like it did in 2003 – 2004 on a volume consistent with 2002 – 2003 (think of a reverse climb back up the same moving average trend line). Prices in the more desirable areas of Nashville will begin to appreciate as much as 5% per annum and even the least desirable areas will experience price stabilization to a certain extent. By the end of 2011, most city leaders, bankers, prognosticators and soap box salesmen will proudly declare an end to the economic downturn, but they will be early in that declaration. The economy still has a ways to go at this point, but the consumer confidence factor will have returned to the residential real estate market in Nashville. It will be during 2011 that Realtors will be able to say that their 4.5 year trip down the rabbit hole has finally ended.