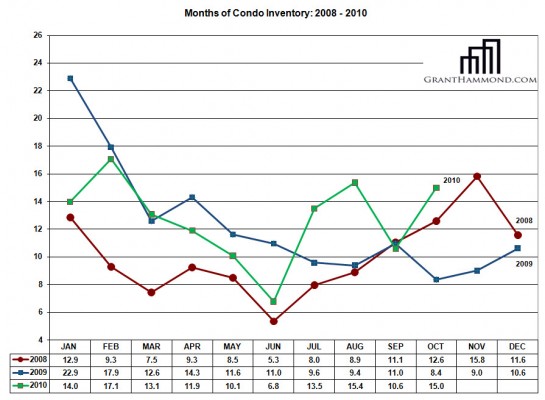

The below line graph is a rather simple analysis that reveals the number months required to clear the market of all current inventory. To arrive at the absorption calculation, I have simply divided the total condo inventory at month’s end by total condos sales for each particular month. While this particular chart really has no predictive value, it is an excellent glimpse into how our 2010 market stacks up against the previous 2 years. This chart represents the pulse of the market, the convergence of seller inventory with buyer action and does bear out several trends.

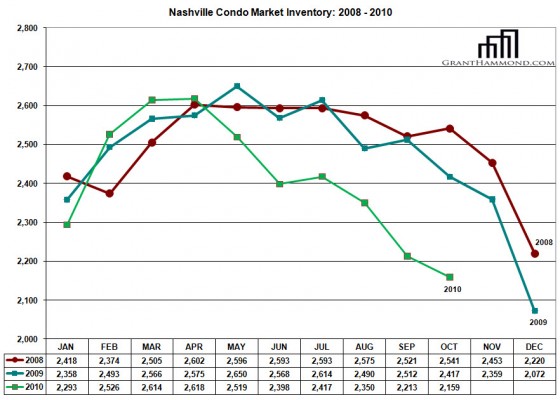

The very first trend demonstrated is that the two Federal Housing Tax Credit programs were very effective on Nashville condo buyers. The first tax credit culminated in the last quarter of 2009 when condo sales are traditionally scarce, but Nashville’s condo absorption rate gained significantly over the previous year. In fact, the 2009 Nashville condo market performed at its peak during the fourth quarter, a complete departure from the norm when the Spring and Summer months almost always outperform the Fall and Winter months. The second housing tax credit concluded in May and June of this year. Not surprisingly, the following two months saw a lack of new purchases as inventory levels actually lowered (see second analysis below). We can certainly call this phenomena the “tax credit hangover effect”.

The second trend demonstrated is the cyclical nature of the Nashville condo market. Unless there is an artificial stimulus, like a Federal housing tax credit, February through August is the period when the condo market accelerates. Of course, the 2010 summer months are skewed, but if you average the two months preceding the end of the tax credit with the two months directly following the conclusion, you’ll find that 2010 mirrors the path of 2009.

Inventory Absorption Conclusion

Averaging all of the absorption data from the previous 36 months, it appears that the Nashville condo market clicks along near equilibrium when it carries between 8.5 and 9.7 months of inventory on the market. This is the point at which prices are stable and inventories remain virtually unchanged. For the Nashville condo market to shed some weight, we need the absorption rate to drop below 8.5 months for an extended period of time. Until that time, until more new construction inventory is absorbed (I predict another 27 months), we will not see significant or sustained price increases.

See condos for sale in downtown Nashville

See condos for sale in the Gulch