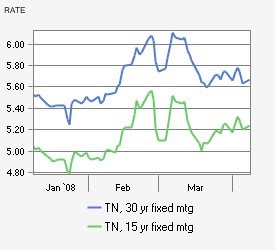

National average mortgage borrowing costs were up slightly for the week, reports Freddie Mac. According to the company’s figures, interest on 30-year fixed loans bumped up to 5.88% from 5.85% a week ago; while 15-year fixed loans rose to 5.42% from 5.34%. However, adjustable-rate products moved in the opposite direction with the one-year ARM dipping to 5.19% from 5.24% and the five-year ARM sliding to 5.59% from 5.67%.

The Fed is meeting at the end of the month to discuss the discount rate and it is widely believed that they will lower that rate a quarter point to 2.00%. This drop should proliferate through the institutional systems by the end of May leading to much lower rates this Summer. If you are a seasoned real estate investor, you should begin making your moves now before the rest of the country wakes up.

If you enjoyed this post, you may also enjoy: