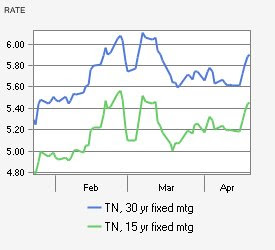

30 year fixed interest mortgage rates currently sit at 5.88%, and some industry analysts say they are unlikely to fall any further for the rest of the year. Interest on 30-year fixed loans is only down a quarter of a point, as the credit markets have cut the link between it and yields on 10-year Treasuries; and while skittish investors have moved to Treasuries to trim the yields, mortgage lenders have not eased lending standards.

Nashville mortgage rates are likely to close 2008 at about 6% as investors in bonds focus on rising inflation and drive interest rates higher. Long-term rates will also increase due to the additional supply of Treasuries as Congress borrows to raise money for the growing federal budget deficit. The rise of inflation is a blow to our 5.5% rate prediction by June of this year, we are still not certain that inflation may ease this summer.

If you liked this post, you may also like: