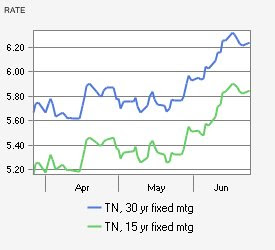

Freddie Mac reports a jump in the 30-year fixed mortgage rate to 6.42% during the week ended June 19 from 6.32% the prior week, marking a nearly nine-month high. The 15-year fixed mortgage rate rose to 6.02% from 5.93%, the five-year adjustable mortgage rates climbed to 5.89% from 5.70% and the one-year ARM jumped to 5.19% from 5.09%.

Freddie Mac chief economist Frank Nothaft attributes the gains to concerns about inflation after the consumer and producer-price indexes for May were issued. Higher mortgage rates sparked an 8.7% drop in loan applications in the past week and a 21% decline year over year, according to the Mortgage Bankers Association. People who have been waiting for the price bottom of the Nashville housing market may have waited too long. Inflation is real and will affect interest rates for the remainder of the year. It’s time to get on that horse and ride or put him up until next year.

If you liked this post, you may also like: