The deadline to challenge your Davidson County property assessment is Friday April 20th at 4:30pm. If you do not challenge your property assessment by this deadline, you WILL NOT be able to seek a reduction until next year!

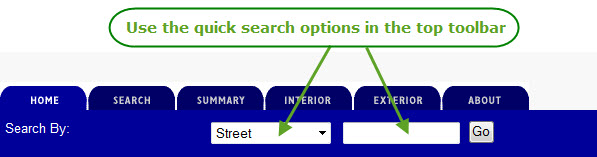

Step #1: Check your new 2011 property tax assessment (click on image below)

Step #2: Locate your property and click on the record

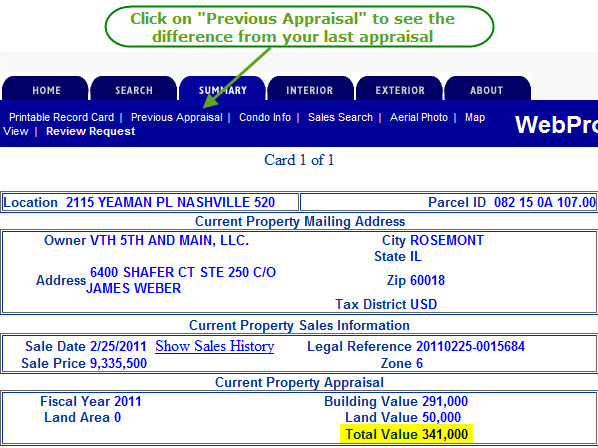

Step #3: Review your tax record. Most importantly, look down to the “Current Property Appraisal” section and find the “Total Value”. This is the amount on which your 2012 property taxes will be calculated.

Step #4: Click on “Previous Appraisal” in the submenu in the top navigation bar

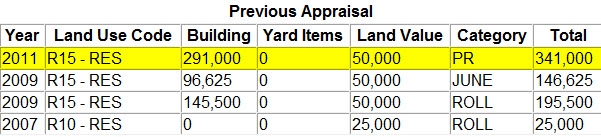

Step #5: Compare your current appraisal with the previous period

Step #6: Determine if you should challenge your tax value assessment. If there is a large difference in your 2011 assessment over your 2009 assessment or if you know the 2011 assessed value to be higher than recent sales in your neighborhood, challenge your assessed value with the Davidson County Tax Assessor’s office immediately. To challenge your assessment, follow the steps outlined in the article I wrote last November.

Who Should Challenge Their Tax Assessment?

While there is no blanket answer, everyone should check their 2011 property assessment to see if a case can be made for a challenge. I have identified pockets of owners who should challenge their tax assessment immediately: owners of luxury homes in Green Hills and Forest Hills over 4,000 square feet should consider challenging. I spot checked several homes that I own in those areas and 3 of them were over assessed. I also found a few over assessments in Hillwood.

Update 4/18/12

This afternoon I received a call from a principle with ACG Equities, the owner/seller of the 5th & Main condos in East Nashville. He explained that ACG took the initiative to challenge all 129 tax assessments as soon as they became aware of the 2011 assessments. I applaud ACG’s actions and can only hope that Pollack Partners follows suit for the Velocity. No word from anyone with Pollack yet.

Please pass this article along to your friends, family, neighbors and clients.