Condo closings in the third quarter did not fall nearly as far as many predicted, but the number of closings did slide 34.34% lower than the previous quarter (824 closings in Q2 to 541 closings in Q3). As with most market analysts, I believe the second Federal Housing Tax Credit compressed 2010 condo purchases into the first 6 months of the year, but I disagree that the tax credit swallowed up all discretionary purchasers. It has been and continues to be my experience that discretionary purchasers tend to let the return dictate the timing on their purchase and that fact is leading to “low hanging fruit” purchases in the second half of this year.

Considering the year to date condo closings, we are slightly ahead of 2009. In 2010 the Nashville market has closed 1,877 condos compared to 1,855 in 2009, a paltry increase indeed. BUT, consider that the current condo inventory is 2,213 compared with 2,512 in 2009 and you’ll realize that Nashville has increased its condo inventory absorption by over a month and a half (1.58 months less inventory on the market). Clearly, this is a result of absolutely no new construction units being brought to market, but that’s exactly what Nashville will experience for at least the next few years which will lead to less and less inventory availability.

Now, for some fun stuff.

Should the current buyer demand remain the same (we can agree demand is historically low) and no new construction condos be added to the market, mathematically speaking, the condo market would only be carrying 3.5 months of inventory by 2015. In other words, by the middle of this decade, the Nashville condo market could be experiencing the same price increases seen during the absolute pinnacle of our market in 2006.

More interestingly, should you insert a simple 5% per annum increase in demand, Nashville is back to crazy condo madness by late 2014. This increase in demand could easily occur as a result of new conventional financing options with lower down payment requirements or qualifying standards. If you think the previous statement is fiction, think again. Banks will return to pre-boom lending practices once their own real estate portfolios are reduced.

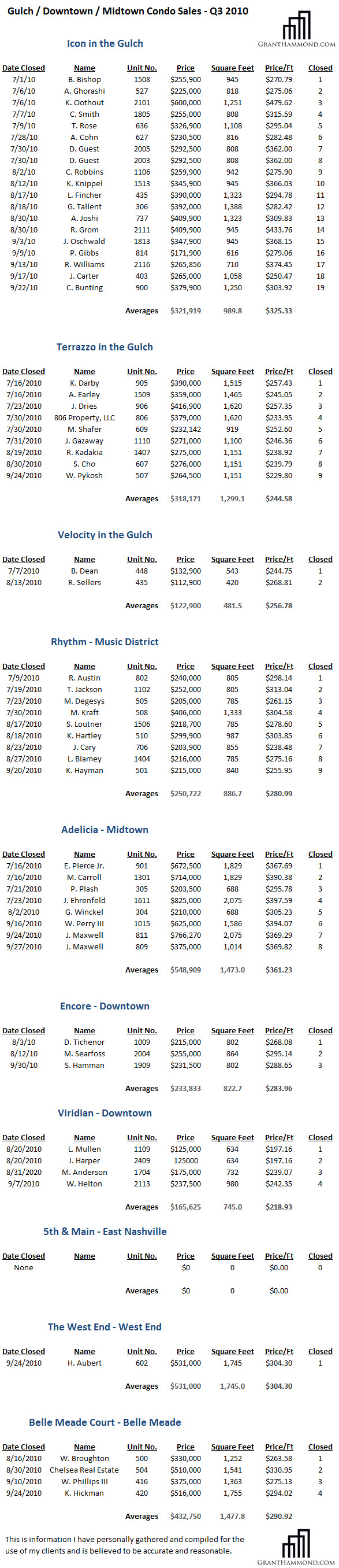

* Listed are the majority of the condo closings in the following areas of Nashville: 1) Downtown CBD, 2) Sobro region, 3) Gulch, 4) Midtown, 5) West End and 6) East bank. I have only considered condo projects that were completed after 2006 and contain more than 60 total units. I have excluded sold out condo projects west of midtown. Those excluded include: Bristol on Broadway, Bristol West End, The Enclave, The Glen and all projects in the West End Circle area with the exception of The West End high-rise.