John Coleman Hayes successfully sold at least 40 condos in the past 60 hours, 32 of which were sold during Saturday’s live auction.

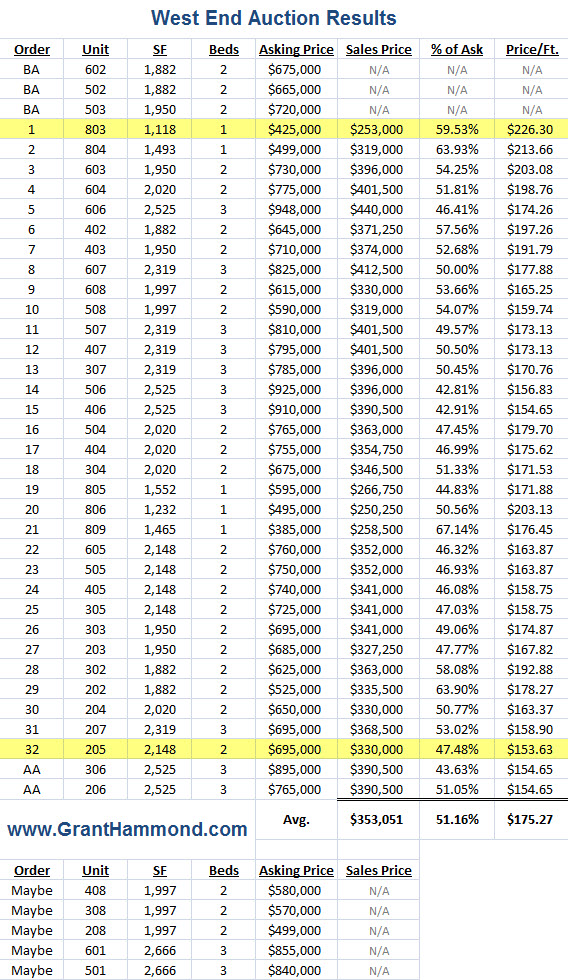

The condo auction, held under a semi-heated tent in the West End’s motor court, was well attended with an estimated 185 potential buyers in attendance. Jerrold Pedigo began the auction promptly at 11:00am by telling auction bidders that 3 condos had sold the prior day and would no longer be a part the day’s auction. The auctioneer did not inform the crowd of the sales prices, but did identify the condos as unit numbers 602, 502 and 503, all 2 bedroom condos with excellent downtown views.

Once the auction began in earnest, the bidding was surprising brisk with the first condo garnering more than a dozen bids and eventually selling for $226.30/ft, an auction high. As expected the next several condos began to sell for slightly lower prices, but the real shock came for me just 5 lots later when the auctioneer accepted a bid of $174.26/ft. Most in the audience seemed surprised that the developer and bank were willing to accept rates lower than $180/ft as well.

Auction prices recovered soon after only to fall to $159.74/ft for the 10th lot auctioned, a 2 bedroom, 2 bath, 1,997 square foot monster condo on the fifth floor. The original asking price for this particular condo was $590,000, but the auction only brought $319,000 after the 10% buyer’s premium was added to the bid price – just over 54% of the original asking price.

The crowd seemed to embrace the auction at this point, redoubling their resolve that this was a day where money could be made in a down real estate market. Most realized that this auction was a true liquidation sale and that all of the condos were going to be sold during or soon after the sale. As such, many causal bidders became serious bidders as their fingers flew across their calculators several times in a virtual effort to pinch themselves.

The auction went on to sell 32 condos at an average of just over $177/ft, well under today’s replacement costs. Soon after the live auction concluded, 2 more three bedroom condos were sold in a flurry of after auction activity and were posted to the auctioneer’s ‘big board’.

As the crowd began to disperse and retreat to the warmth of their cars, more wheeling and dealing was happening in the lobby of the West End. Several would be bidders had gathered around the developer and were lobbing low ball offers left and right for the remaining condos as well as on several of the 3,000-4,500 square foot penthouses. Reportedly, Reese Witherspoon’s father as well as Taylor Swift’s mother had low offers rejected on the two largest penthouses in the building. However, it is believed that at least 5 more auction condos sold during this time.

What’s next for The 72 Condo West End?

With an additional 40 residents added to the 7 already in the building, the West End will presumably soon be eligible for FHA backed financing having 65% of the building sold. When asked, the developer said that he plans on returning the unsold condos to their pre-auction prices and waiting until the Spring or Summer to sell. With the remaining one-third of the condos being much larger penthouse style units, it seems likely that it will take some time prior to selling out the entire building.

However, rumors are circulating that the developer, John Coleman Hayes, is having trouble with two apartment complexes recently built next to MTSU in Murfreesboro. Some believe that Mr. Hayes is in danger of defaulting on one of the construction loans which are serviced by Grandbridge Capital, a subsidiary of BB&T. I have found no corroborating evidence of this rumor to date however, I did confirm that Mr. Hayes did build student housing near MTSU and that there is approximately $50 million in debt on those projects.

Assuming that this rumor is not true and that Compass bank will be satisfied with receiving more than $14 million by January 15th, I would expect (hope) that the West End condos will return the unsold condo prices to higher levels, but not as high as the pre-auction prices. Although, it is very hard to price the condos much higher than the auction prices due to future appraisal concerns. This concern does not affect the penthouse style condos as much as condos that are similar to those in the auction.

What’s next for the Nashville condo market?

Good question, but the answer is wholly obscured. The Terrazzo in the Gulch recently auctioned off 25-28 of their remaining condos and some expect one other condo project to follow suit within the next 3 months. The 5th & Main condo project in East Nashville has been parked in receivership since February as has the 136 unit, 2 tower Braxton condo development in Ashland City (yes, Ashland City).

The Rhythm at Music Row has sold 30% of their 105 condos, the Icon in the Gulch has sold 48% of their 420 condos and the Encore has sold almost 80% of their 332 condos. Condo inventory is burning off, but is that rate fast enough for the banks who are holding these construction loans? That answer is unknown, but recently prices in all of these buildings have begun to inch downward. By the same token, sales have increased and the most desirable condos are being picked off the market faster than the main stream media realizes.

Should the Nashville City Council approve the financing for the new Nashville Convention Center and reuse of the old convention center for the new Medical Trade Center in January 2010, available condos could become scarce by 2013.