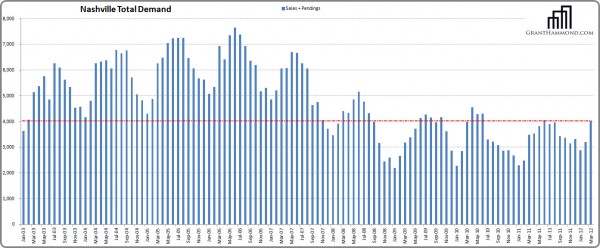

Realizing that predicting the real estate market is a dangerous enterprise at best, I feel confident in the simple science behind my prediction that future Nashville home demand will jump significantly in 2012. Before I explain why, let me first explain how I build the total demand curve. I define total demand as the number of homes purchased in a particular month plus the number of pending home sales reported in that same month (some have included the number of residential building permits issued as well, but for the purposes of modeling an actual demand, not a confidence factor, I prefer to keep my curve based purely on the demand side). In my opinion, actual sales and pending sales added together give a real time look into the future health of the market, but rooted in reality. Think of the actual sales figure as the anchor that helps stabilize the sometimes unwieldy predictive value of the pending homes figure. Further, understanding that seasonality plays a role in the Nashville market, I have broken the “demand season” into several separate segments.

As you may have noticed, I have purposefully left out mortgage rates as I believe rates and affordability, to a great extent, will have no bearing upon new purchases for the balance of 2012. For the micro economists out there, yes I realize that it is impossible to hold all other factors constant to specifically measure pure demand in a market as complex as real estate, but bear with me as I strip down purchase demand into its purest state.

For the past 9 years, the average total demand has increased 10.94% between the months on March and June with June being the peak of seasonal total demand. If that same trend were to hold true, the total demand in June 2012 would rise to roughly 4,500 homes. This is a level last achieved in April 2010. If you recall, this was also the period in which the Government back first-time homebuyer credit expired creating an artificial demand. Having already achieved a total demand greater than any month in 2011, it is my conclusion that the Nashville real estate market demand has not only recovered, but may see significant price increases within the next 18 months.

Looking at the More Recent Demand Trend

When we strip out the 2 years of governmental meddling as well as 2003 and 2004 and only consider the 5 most recent years of pure market forces, the average total demand has increased 13.78% between the months of March and June. This more realistic view would predict a demand of almost 4,600 homes, a level not seen since the seasonal highs in 2008. More importantly, this level of demand is similar to what was achieved in the first quarters of both 2004 and 2005. While it is too soon to predict the next boom, I do feel that Nashville is firmly entrenched in a steady recovery that will lead to price increases.

Adding to the strength of the recovery is the fact that the Millennial generation (born between 1980 and 2005) has been graduating from college and graduate school for several years. This is significant as the Millennial generation, sometimes called Echo Boomers are the largest generation of Americans, ever. Millennials are 1.3 times larger than the Baby Boomers and over 3 times larger than Generation X, my generation. Millennials have many of the same values as their parents with home ownership being a focus and main definition of their self worth. It stands to reason that as this generation comes of age, so shall the real estate recovery.

Nashville Market Gains Confidence

In speaking with several colleagues at REBAR last week, almost all report the number of multiple-offer situations and “bidding wars” having increased significantly in recent months. Moreover, 8 out of 10 polled Realtors reported an increased confidence among their buyers and 7 out of 10 reported an increased confidence among their sellers.

Further, having the confidence that mortgage rates will remain relatively low through late 2014 due to the Central Bank’s decision to hold short-term interest rates near zero for the next 28 months, has set the stage for a 28 month purchase window. Buyers are certainly not in a rush, but most now operate with the understanding that purchasing a home within the next two years represents their best chance at optimizing the affordability factor. However, as many begin to see increased pricing in the more desirable areas of Nashville, many will pull the trigger in 2012 to further optimize that transaction. Areas like 12th South, Green Hills, Vanderbilt and the Gulch have already seen significant price gains in the past year.

Work with Grant Hammond

I have a true passion for real estate. Each transaction becomes personal and every deal is negotiated as if it were my own. I would never advise one of my clients sign a purchase or a sale I did not believe in. Many of my clients describe my real estate practice as professional, thorough, and detailed oriented and some have even called me anal and slightly obsessive. I feel all are compliments. But, the one trait I possess that very few agents have is the ability to walk away from a deal. In that I mean, I am financially in a position that allows me to advise my clients to walk away from a deal that is not perfect and continue looking for the best property or wait for a better offer. It has always been and always will be my goal to put my clients in the best position to succeed.

Grant Hammond, Owner/Broker, ABR, SFR, ePRO

Call or Text: 615-945-7123

Grant@GrantHammond.com

Navigate back to my Nashville real estate home page to see additional articles I have authored.