There were 1,495 home closings in Nashville reported for the month of October 2010, according to figures provided by GNAR. This figure is down 30.3% from the 2,145 closings reported for the same period in 2009. Year-to-date closings through October 2010 are 17,424, representing a 1% decrease from the 17,598 closings reported through October 2009.

There were 1,495 home closings in Nashville reported for the month of October 2010, according to figures provided by GNAR. This figure is down 30.3% from the 2,145 closings reported for the same period in 2009. Year-to-date closings through October 2010 are 17,424, representing a 1% decrease from the 17,598 closings reported through October 2009.

The median residential price for a single-family home during October was $173,525, and for a condo it was $152,950. This compares with last year’s median single family home and condo prices of $160,000 and $144,000, respectively. Total inventory at the end of October was 22,826, compared to 23,398 in October 2009, a moderate, yet encouraging 2.5% decrease.

There were 1,439 sales pending at the end of the October 2010, compared with 2,106 pending sales at this time last year. The average number of days on the market for a single-family home was 94 days, 9 days longer than October 2009.

Micro-analyzing Monthly Real Estate Data

The practice of micro-analysis can produce somewhat harmful buying and selling decisions. I have always maintained that a larger data focus is necessary in order to more fully understand how to better prepare yourself for a real estate transaction. It is with this principle in mind that I fear a false positive for rising home prices in Nashville (although, I did predict an increase in Nashville home prices in May).

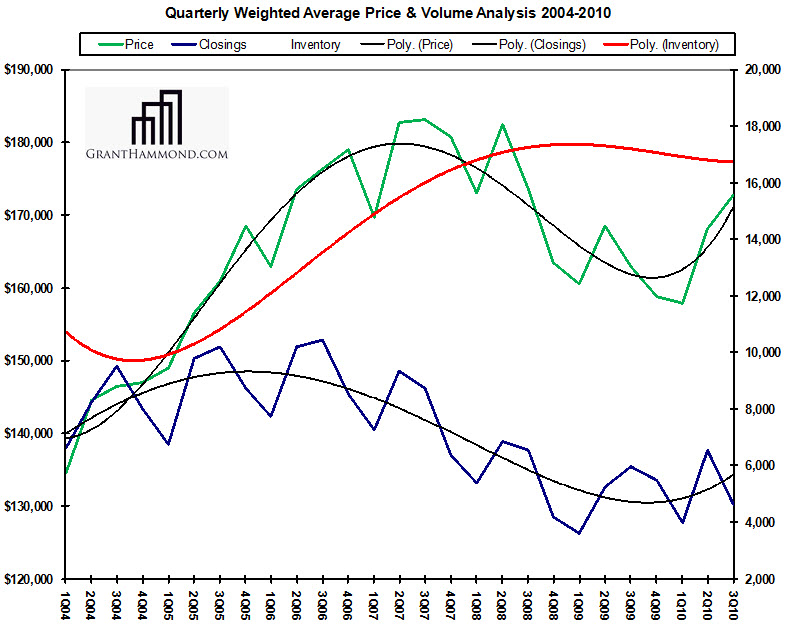

On the graph below, the red trend line represents the total housing inventory. The green line is the average median home price and the blue line is the total number of home closings in Nashville. One glance at the trend lines shows a rather drastic upward trend in pricing based upon a rather small decline in inventory coupled with a small increase in the total number of closings. This is a pricing trend that seems wholly unsustainable based upon the past 6 years of data for the Nashville housing market.

Unsustainable Nashville Real Estate Trend

Clearly, there are an infinite number of additional market forces that affect the direction of the Nashville housing market, but indulge me in this oversimplified analysis for a few more minutes. Based upon the trends, it seems as if real estate prices reacted extremely favorably once the total housing inventory began to only plateau or stabilize. Via a miniature quarterly increase in closings and certainly a decrease in new housing starts, the pricing component of the Nashville market is completely out of whack. What could explain this increase? Did the Federal Housing Stimuli artificially hold prices lower beginning in Q3 2009 and ending in Q2 2010? Are Nashvillians so susceptible to positive news that we’ll run right out and pay more for real estate? Only time will tell.

Nashville Housing Market Prediction

It is my opinion that median home prices will ultimately fall into the $164,000 neighborhood by Q1 2011 as total inventory continues a modest decrease. The gains from increased closings in 2011 will be negated by the return of shadow inventory to the market as renters cycle off leases. This leads 2011 to become a rather blah year in terms of sustained recovery. I do not believe 2011 will become the year we look back upon and say, “that was the bottom of the market”. Rather, I believe we’ll look back and say, “2009-2011 was the bottom of the Nashville real estate market”.