I have read either this exact sentence or a very close derivation of it about a dozen times since the Greater Nashville Association of Realtors (GNAR) published the February 2010 home sales results: “Home sales are already at a frenzied level in the first month of the year so you better hurry! Inventories are at historic lows and interest rates are great.”

I suppose I shouldn’t be surprised by the overreaction to good news in the real estate community, but I am a little surprised that the Nashville news media has jumped onto the bandwagon so quickly. Looking at just last year’s numbers, you’ll quickly see that Nashville really isn’t too much better or worse off than it was 12 months ago with the exception of pending sales. In January 2009 only 924 homes and condos closed during the month, the lowest number since 1994. In January of 2010 an astounding 985 homes and condos closed (yes, I know this is dripping with sarcasm), the second time in 16 years the total number of sales dipped below 1,000 total closings for the month. The year over year increase of 6.6% is hardly a solid foundation on which to build a housing recovery argument.

More bad news is that since December 2009, market inventories have been increasing at surprising rates, 14.2% in just over 2 months. Clearly, the decreased absorption rate during this period is disappointing, but the trend reversal is the more distressing item for me. During the same period in 2008-2009, Nashville inventory levels only rose 8.56%.

To add further insult to injury, the 2010 February over January inventory levels have increased 5.47% whereas those levels only increased 3.10% in 2009.

Okay Mr. Sourpuss, What About the 25.08% Increase in Real Estate Closings?

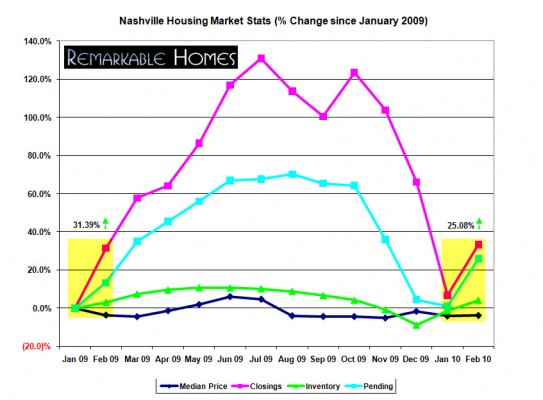

I agree that a 25.08% February over January closing increase is substantial and not to be ignored; however, a year ago this same period saw a 31.39% month over month increase in closings. This is a market trend that has repeated itself 10 out of the past 10 years and thus, I am discounting its significance.

The Bright Side of the Nashville Rainbow

Pending sales, ah pending sales, how I love thee. The month over month increase of 24.63% represents the single largest increase in pending sales since March of 2005. This is significant in that pending sales are a pure indicator of future closings and future closings directly lead to inventory reduction (in a balanced market). Could this renewed activity be a result of the tax credit or perhaps pent up demand finally being released? Yes, but neither I nor anyone else is going to be able to tell you the mixture until much further down the road. By comparison, in 2009 pending sales only increased by 13.26% in the first month of the year.

What Other Real Estate Agents are not Saying

The Nashville real estate market is still a buyer’s market. If you are a seller who has to sell this year, I’m sorry, but your home is not worth what you think it’s worth. In fact, the current median price of $159,900 is exactly what it was in May of 2005. Yes, I said it. Your house, according to the open market, is worth what it was 5 years ago. Of course, there are several exceptions in the more desirable areas of Nashville, but if I had to ballpark the Davidson home sales trend, this is what the numbers say. In the same breath, only the best homes (cleanest, renovated, biggest deals, distressed, etc) are the homes that are even receiving offers. In case I have not applied enough force to the above kick in the pants, you have to go back to 2001 to find the total number of monthly closing near 1,232 (excluding the past 15 months).

We’re Always 12 Months Behind in Nashville

The above title sounds like a bad thing, but in this case, it is not. Because Nashville real estate values continued to rise 12 months past more than 70% of the nation’s we have been able to cushion the overwhelming pessimism that has permeated their real estate markets. In other words, the rest of the country feels pretty good about Nashville and I am seeing signs of their money being spent on our city’s real estate. This action will inevitably lead to more local money being spent on our real estate and will lead to a faster exit from real estate valuation prison, a place we have only really been in for a year. I hate to repeat it, but “a rising tide lifts all ships.”

Call me Crazy

The Nashville market will not stay a buyer’s market for more than the next 14 months. Yes, you just finished reading my written tongue lashing of the current market, but we do only have 13.6 months of inventory on the market and new construction has slowed 61.24% in just the past year. There is still a looming shadow inventory out there as well, but looking at Nashville’s job predictions + stable wage growth + current investment minus over 60% of the new residential construction and, well, you get my drift. As long as the 30 year fixed mortgage rate stays below 6.125%, we’re looking at a pretty nice little market by 2012-13.

Buy soon, buy BELOW current market values, buy desirable property in desirable areas and REAP the benefits by 2013. Go reap!

BTW – sellers listen to me here. If you sell your house at what you consider to be a 10% loss and then go purchase a distressed sale at a 25% discount, you are still increasing your equity by 15%. DO NOT be afraid to sell your house for a little less that you would like if you can replace it with a killer deal. Go ask a stock trader if they would have liked to have sold their Toyota stock 3 months ago and replaced it with Ford.