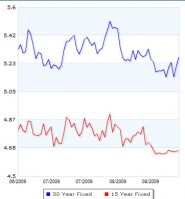

Freddie Mac reported a dip in borrowing costs for long-term mortgages this week. According to the federally chartered company, the average interest on 30-year loans fell to 5.08 percent from 5.14 percent a week ago; while rates on 15-year loans came down to 4.54 percent from 4.58 percent. Adjustable-rate mortgages declined as well, with the one-year ARM sliding to 4.62 percent from 4.69 percent and the five-year ARM moving down to 4.59 percent from 4.67 percent.

Banks are still leery of investment purchasers and are typically hitting the above rates by a full point. Lenders are really after the crème of the crop primary residence buyers in Nashville who have good credit scores and a decent amount of monies in reserve. The good news is that most banks are loosening their down payment requirements and are starting to look at second home buyers as humans again.