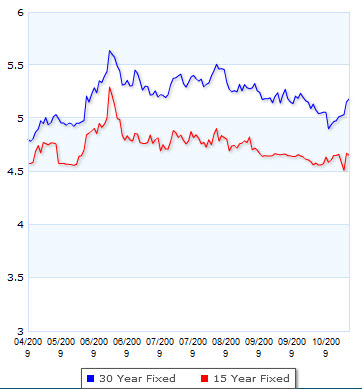

Fewer consumers sought home loans last week as the national average interest on 30-year fixed mortgages bumped up to 5.02 percent from 4.89 percent the week before, the Mortgage Bankers Association reported. At the same time, the average rate for a 15-year fixed loan rose from a record low of 4.32 percent back up to 4.44 percent. Demand for mortgages was down 1.8 percent overall for the week, with requests for purchase loans sliding 5 percent and refinance applications dipping by 0.1 percent. MBA said it anticipates 30-year loan rates averaging about 5 percent this quarter but rising as high as 5.6 percent by late 2010.

Fewer consumers sought home loans last week as the national average interest on 30-year fixed mortgages bumped up to 5.02 percent from 4.89 percent the week before, the Mortgage Bankers Association reported. At the same time, the average rate for a 15-year fixed loan rose from a record low of 4.32 percent back up to 4.44 percent. Demand for mortgages was down 1.8 percent overall for the week, with requests for purchase loans sliding 5 percent and refinance applications dipping by 0.1 percent. MBA said it anticipates 30-year loan rates averaging about 5 percent this quarter but rising as high as 5.6 percent by late 2010.

It appears to be safe to wait until the end of the year to make a real estate purchase in Nashville. We are all trying to time the bottom of the market and that can be a very difficult feat to accomplish. According to my monthly market analysis reports, the intersection of low prices, low mortgage rates and the optimal time to acquire a Nashville condo or home will be the very end of 2009 to beginning of 2010.