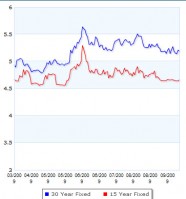

Nashville home-loan rates remained near three-month lows this week and dipped even closer to the 5 percent threshold, Freddie Mac reported in its survey this past week. According to the firm, average interest on 30-year fixed loans fell to 5.04 percent from 5.07 percent a week earlier; while 15-year mortgages averaged 4.47 percent, down from 4.5 percent the prior week. Five-year adjustable-rate mortgages held steady at 4.51 percent, while one-year ARMs dropped to 4.58 percent from 4.64 percent. Freddie Mac economist Frank Nothaft believes the pattern of decline could lead the survey to a record annual low for 2009.

Nashville home-loan rates remained near three-month lows this week and dipped even closer to the 5 percent threshold, Freddie Mac reported in its survey this past week. According to the firm, average interest on 30-year fixed loans fell to 5.04 percent from 5.07 percent a week earlier; while 15-year mortgages averaged 4.47 percent, down from 4.5 percent the prior week. Five-year adjustable-rate mortgages held steady at 4.51 percent, while one-year ARMs dropped to 4.58 percent from 4.64 percent. Freddie Mac economist Frank Nothaft believes the pattern of decline could lead the survey to a record annual low for 2009.

Rates cannot remain this low for much longer as inflationary pressures begin to mount in the financial markets. Many economists are eager to point out that mortgage rates have been held artificially low by the current administration and that rates cannot remain this low for very much longer.

This is the first time in history that the United States has come out of a recession with interest rates at these levels. The combination of falling real estate prices and very low interest rates should help burn off much of the inventory and certainly, all of the superlative deals.