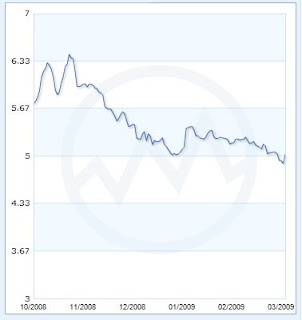

With the Federal Reserve planning to purchase another $750 billion in mortgage-backed securities and up to $300 million in Treasuries, Freddie Mac reports a drop in long-term mortgage rates. The average interest on a 30-year loan fell to a 38-year low of 4.85 percent during the week ended March 26 from 4.98 percent the prior week.

Frank Nothaft, Freddie Mac vice president and chief economist, noted: “Rates for 30-Year fixed rate mortgages peaked last year at 6.63 percent on July 24th. With this week’s 30-Year fixed rate mortgage, the interest rate difference is almost 2 percentage points, which amounts to a savings of about $225 in monthly mortgage payments for a $200,000 loan.”

“And potential home buyers are taking notice of these historically low mortgage rates. Both new and existing home sales rose 5 percent in February. First-time home buyers accounted for half of all existing home sales, according to the National Association of Realtors. In addition, mortgage applications for home purchases consecutively rose over the first three weeks in March, based on figures published by the Mortgage Bankers Association.”

Many of these new home purchases are coming as a direct result of the sheer number of residential auctions being held in major metropolitan cities. On the flip side of the coin, commercial real estate sales have slumped to 28 year lows with no clear bottom in sight.