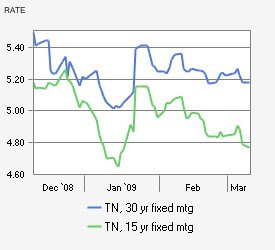

Freddie Mac reported that 30 year fixed rate mortgages averaged 5.15% during the most recent survey week. That marked an increase from 5.07% the week prior. While the move appears modest, changes in Nashville mortgage rates can influence buyer activity and affordability in the Nashville housing market.

Mortgage rates often track long term bond yields. During this period, bond yields moved higher following reports of slower fourth quarter economic growth and rising jobless claims.

Why Nashville mortgage rates can rise during slower growth

At first glance, weaker economic data might suggest lower rates. However, mortgage pricing reflects expectations about inflation, Federal Reserve policy, and long term capital flows. Because of this, bond yields can increase even when parts of the economy show signs of slowing.

Freddie Mac’s chief economist also noted that housing market conditions can affect rate movements. When national housing activity moderates, lenders adjust pricing and risk models accordingly.

What rising mortgage rates mean for Nashville buyers

Even small changes in Nashville mortgage rates affect monthly payments. As a result, buyer purchasing power can shift quickly, especially in competitive neighborhoods across Middle Tennessee.

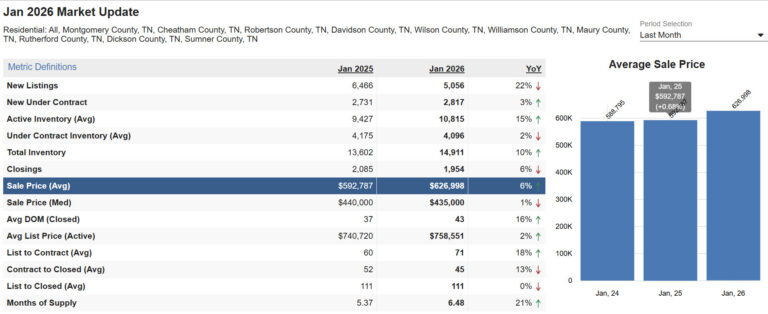

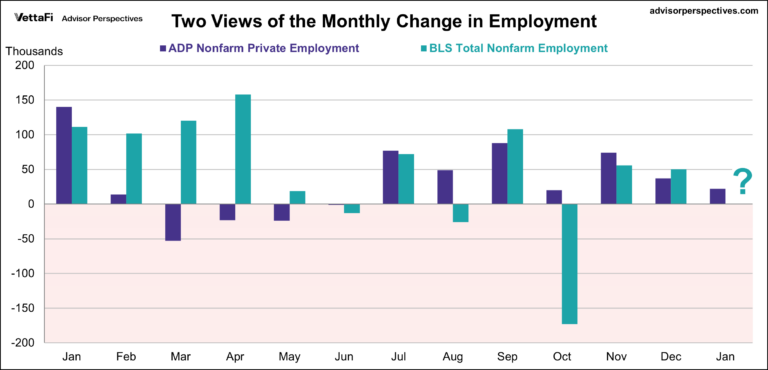

However, mortgage rates represent only one factor. Local inventory levels, employment trends, and migration patterns also shape housing demand.

When rate increases occur gradually, buyers often adjust expectations rather than exit the market entirely. Understanding how financing costs interact with home prices helps both buyers and sellers plan effectively.

Monitoring Nashville mortgage rates remains an important part of evaluating broader housing market trends.