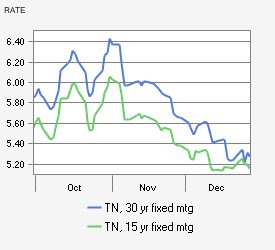

In response to the Federal Reserve’s cut in the federal funds rate to near zero, Freddie Mac reports that the 30-year fixed mortgage rate fell to 5.17% during the week ended December 18 – down from 5.47% the previous week and the lowest since 1971!

Interest on 15-year fixed loans slipped to 4.92% from 5.20%. Meanwhile, the five-year hybrid adjustable mortgage rate dropped to 5.60% from 5.82%; and the one-year ARM dipped to 4.94% from 5.09%. A year ago, the 30-year fixed rate stood at 6.14%, the 15-year fixed rate at 5.79%, the five-year hybrid ARM at 5.90%, and the one-year ARM at 5.52%.

This incredible drop in rates has kicked off what might be the largest refinance boom in the past 3 decades. We certainly expect borrowers to kick those adjustable rate mortgages to the curb in favor of the safer and more secure fixed rate mortgages.

If you liked this post, you might also like:

Catch Your Breath, Mortgage Rates Change Little

Nashville Mortgage Rates Bump Up

Mortgage Rates Rise After 3 Weeks of Decline