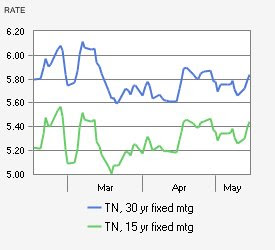

The 30-year fixed rate mortgages in Nashville slipped to 6.05% from 6.06% a week ago, while the 15-year fixed rate mortgages bumped up to 5.60% from 5.59%. Over the same period, the five-year adjustable mortgage rate fell to 5.67% from 5.73%; and the one-year ARM held steady at 5.29%. Nothaft cites a report from the U.S. Census Bureau indicating a decline in the national home ownership rate to 67.8% in the 2008 first quarter from 69% in the 2006 third quarter.

Freddie Mac chief economist Frank Nothaft says the housing slump, along with rising mortgage delinquencies and foreclosures, has taken a toll on home ownership rates and prevented significant movement in mortgage rates during the week ended May 8. It appears that we are still in the forest and it is hard to see the edge of the woods for all of the trees.

Looking back at the April home sales data in Nashville, the city appears to be leveling off and might see a stabilization by the end of the year, but still look for quite a few foreclosures this summer. It will be a very fertile time for Nashville investors to make some real money.

If you liked this post, you may also enjoy: