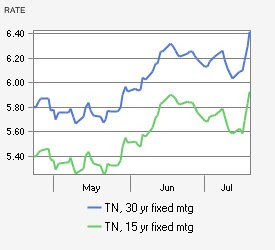

Freddie Mac reported a more than quarter point increase in the 30 year fixed rate mortgage to 6.63% for the week ending July 24. That marked the highest level since rates reached 6.68% the previous August.

The 15 year fixed rate mortgage rose to 6.18% from 5.78%. The five year hybrid adjustable mortgage increased to 6.16% from 5.80%. In addition, the one year adjustable rate mortgage climbed to 5.49% from 5.10%.

Even modest rate changes can influence affordability and sentiment in the Nashville housing market.

Why Nashville mortgage rates increased

Freddie Mac’s chief economist attributed the rise to market concerns about inflation, housing market weakness, and the possibility of additional Federal Reserve rate hikes. When investors anticipate higher short term rates, long term bond yields often move upward. Because mortgage pricing follows long term yields, rates can rise quickly during periods of uncertainty.

Oil prices and inflation expectations also affect bond markets. When inflation concerns intensify, lenders typically demand higher yields to offset purchasing power risk.

What rising mortgage rates mean for Nashville real estate

Higher Nashville mortgage rates increase monthly payments and can reduce purchasing power. As a result, buyer activity may adjust, particularly in price sensitive segments of the market.

However, rate volatility does not operate in isolation. Inventory levels, employment trends, and migration patterns continue to shape demand across Middle Tennessee.

Periods of financial uncertainty often produce short term fluctuations. Monitoring Nashville mortgage rates alongside broader economic conditions provides a clearer picture of local housing trends.