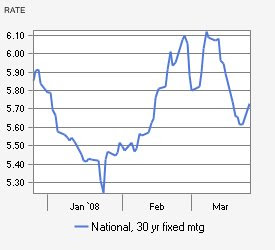

According to Freddie Mac’s data, national average mortgage rates dropped back below 6% after spending more than a month above that threshold. Thanks to the Federal Reserve’s aggressive moves to insulate the U.S. economy by slashing borrowing costs, 30-year fixed home loans averaged 5.87% for the week ending 3/20/08. That compares to 6.13% a week earlier and represents the first time since mid-February that the benchmark interest rate has been less than 6%.

“Slowing consumer spending and weak employment conditions are among the concerns behind the Fed’s decision to lower the target federal funds rate,” said Freddie Mac chief economist Frank Nothaft. However, the Nashville housing market should get a boost from this drop.

If you liked this post, you may also like: