As 2011 draws to a close and I listen to traditional media pontificating on the woes of national home sales, I am again reminded of how fortunate I am to live and work in Middle Tennessee. Many have made the argument that luxury home sales ($500,000 to $2,000,000) have suffered most during the economic downturn and that may be partially true, but my analysis below proves that Williamson County has not only fared the best, but has recovered the quickest. The volume of luxury and ultra luxury home sales ($2,000,000+) has not already bottomed out, but did so in 2009, two years ago. This information comes to a surprise to many who have been misled by our local media who continue to report that luxury housing levels remain near record lows. I also make the argument that average price is not the best indication of heath for a real estate market. Rather, volume and velocity combined are better indicators of heath, trend, attitude and sustainability.

As 2011 draws to a close and I listen to traditional media pontificating on the woes of national home sales, I am again reminded of how fortunate I am to live and work in Middle Tennessee. Many have made the argument that luxury home sales ($500,000 to $2,000,000) have suffered most during the economic downturn and that may be partially true, but my analysis below proves that Williamson County has not only fared the best, but has recovered the quickest. The volume of luxury and ultra luxury home sales ($2,000,000+) has not already bottomed out, but did so in 2009, two years ago. This information comes to a surprise to many who have been misled by our local media who continue to report that luxury housing levels remain near record lows. I also make the argument that average price is not the best indication of heath for a real estate market. Rather, volume and velocity combined are better indicators of heath, trend, attitude and sustainability.

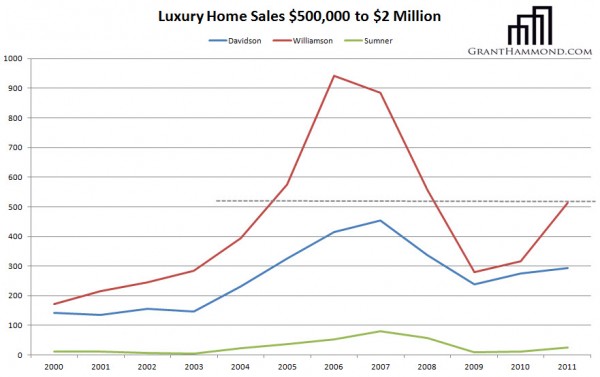

Total Luxury Homes Sold

For the sake of this analysis, I have limited the definition of a luxury home to a home with a minimum of 2,750 heated square feet, a lot size not to exceed 5 acres and a price between $500,000 and $2,000,000. What I find most interesting in this graph is the absolutely precipitous fall of home sales in Williamson County during 2008 and 2009. During that 2 year period alone, Williamson County gave back all of the gains made since 2003. However, since 2009, Williamson County has returned to 2005 levels by increasing sales by a whopping 183.6% over the last 2 years. By comparison, Davidson County was not as acutely affected during 2008 and 2009, but it too has seen luxury home sales return to 2005 levels.

In the case of Williamson County, the trend is quite conclusive. The volume of luxury home sales is escalating and is well on its way to reaching pre-bubble levels. In Davidson and Sumner Counties, the trend is not as bullish. Both have made progress since 2009, but each has recorded modest annual gains.

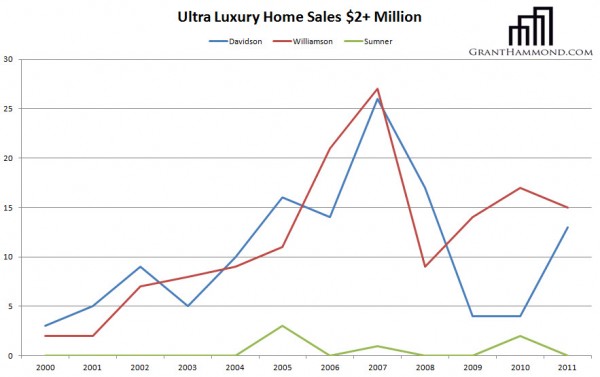

Total Ultra Luxury Homes Sold

For the sake of this analysis, I have defined an ultra luxury home to be a property with a minimum of 5,000 heated square feet and a price to exceed $2,000,000. Due to the lack of volume, it is difficult to render any concrete conclusions, but I was a little amazed to see Williamson County consistently out sell Davidson County in this market segment. Perhaps coincidental, but the ultra luxury sales market appears to have followed the same trajectory as the luxury sales market. So much for the argument that the ultra rich were the only ones spending money during the recession.

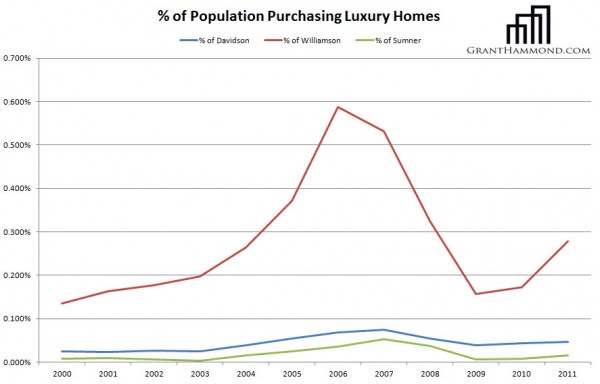

Total Luxury Homes Sold by Population and Households

Taking the analysis one step further, I find it helpful to compare the total number of luxury home sales to consistent and measurable baselines. These serve as a backstop for the trend. The first two are total population and total households for each county as provided for by the US Census. As you can see below, while Williamson County does outperform Davidson and Sumner Counties, it is also more volatile for its size. This leads me to believe that Williamson County could be more price sensitive and experience greater price highs and lows. Regardless of price, you can clearly see Williamson County gaining momentum since 2009, accelerating in 2010.

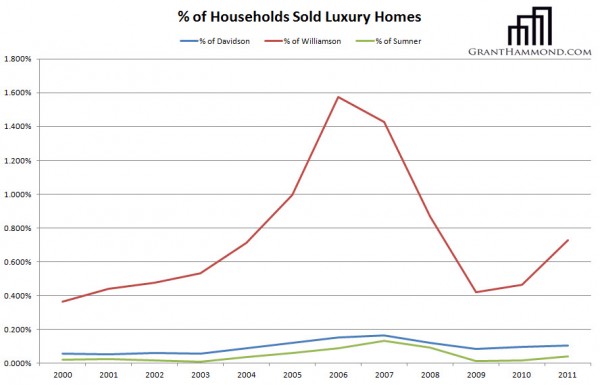

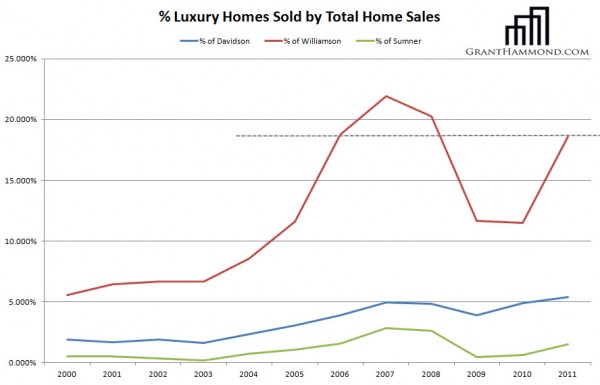

Total Luxury Homes Sold by All Home Sales

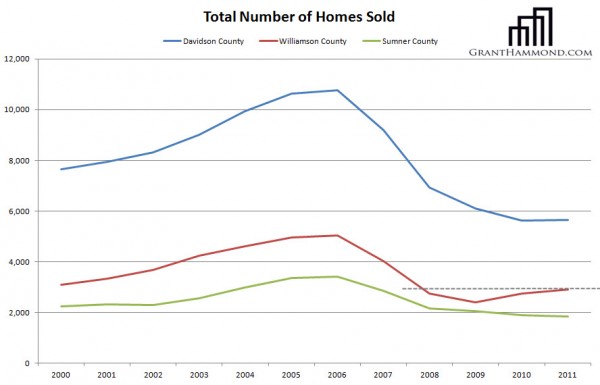

To first understand why this statistic is important, you must first subscribe to the theory that no matter how many homes are sold, the grouping of price points is important. In simpler terms, one can measure the healthiness of a particular market segment during any economic climate by simply comparing that segment’s sales to the overall sales over a period of time. In order to make this analysis we first need to look at all single family home sales over the past eleven years:

The first item that jumps off the graph is that Williamson County is the only County that has made a significant recovery in total home sales since 2009. Davidson County appears to be bottoming and Sumner still has progress to make. The second interesting fact is that not one of the counties has returned to 2000 total volume levels. This is troublesome as it indicates weakness in the below luxury home price points. Joe the Plumber is not buying homes. This leads me to believe that, as an economic indicator, the segmentation of our population has true merit. Perhaps the 99% have a point.

However, as we make the comparison of luxury homes sold to all single family home sales, you will note significant growth, even during the recession. It’s amazing to think that 1 out of every 5 homes that sold in Williamson County in 2011 was a luxury home, but that is exactly what occurred. This is the same level achieved in 2006. What may be more astonishing is that in Davidson County, the percentage of luxury homes sold has never been higher. The takeaway is clear, the purchasing power lies as the top of the spectrum and that market segment is shouting that they feel confident in the Nashville economy.

The foregoing analysis coupled with historically low jumbo mortgage rates leads me to believe that potential buyers of luxury properties should step into the market now. Likewise, those sellers who have postponed listing their properties may find motivated buyers anxious to buy in at this time.

Did you know that you can accurately calculate the current market value of your home? I use 3 different data sets and personally review prior to final presentation. I hope you find it useful in your quest to refinance your mortgage, update your insurance coverage or in evaluating the opportunity to sell your home.

Contact me for a private and confidential consultation.